Our experience with different UBP companies across industries shows that there are 5 key action items to consider when deploying the pricing model. The list is of course not exhaustive but examines the most challenging questions to address initially. The first three revolve around price and pricing topics. The remaining two deal with operational and organizational questions.

Ascertaining value to customer and determining price level

The first step in any pricing discussion should naturally revolve around price. Before any discussion on how or when customers will pay for a service or product, each company needs to analyze how much it will charge. To do so, they need to start with estimating the value customers will derive from the product or service. This value will likely be on a spectrum, portions of which will be highly attributed to the product and portions of which will have a low attribution.

Based on our experience, it is usually possible to set prices at 20-30% of customer incremental value that is indisputably attributed to the service or product provided, with some variance across industries.

Choosing the right pricing metric

After the price level has been set, it’s time to choose the appropriate pricing metric.

After the price level has been set, it’s time to choose the appropriate pricing metric.

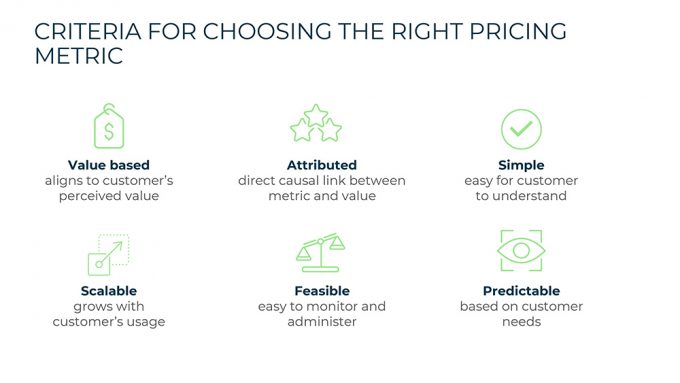

This metric should meet a number of criteria:

– Value based – aligns with customer’s perceived value from product

– Attributed – direct causal link between metric and value

– Simple – easy for customer to understand

– Scalable – grows with customer’s usage of value attained

– Feasible – easy to monitor and administer

– Predictable – based on customer needs

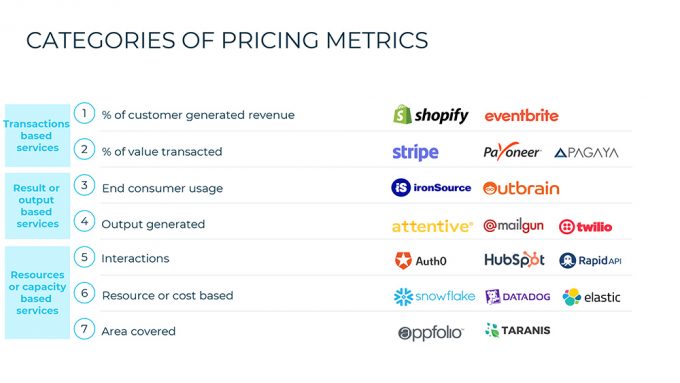

A deep dive into multiple value-based companies reveals several non-exhaustive categories of pricing metrics:

1. Share of customer-generated revenue – prevalent in the e-commerce space (e.g. Shopify, Eventbrite)

2. Share of value transacted – prevalent in the Fintech space (e.g. Stripe, Payoneer, Pagaya)

3. End consumer usage (# of views, # of clicks) – prevalent in the ads space (e.g. Ironsource, Outbrain)

4. Output generated (emails, text messages, etc.) – prevalent in the marketing and communication space (e.g. Attentive, Mailgun, Twilio)

5. Interactions (number of contacts, API calls, subscribers, etc.) – prevalent in the general B2B enterprise space (e.g. Auth0, Hubspot, RapidAPI)

6. Resource or cost based – prevalent in the storage and data spaces (e.g. Snowflake, Datadog, Elastic)

7. Area coverage – prevalent in application for traditional industries such as real estate or agriculture (e.g. Appfolio, Taranis)

Deciding on overarching approach and choosing underage and overage schemes

Once the right metric is chosen, the next critical choice is the overarching pricing approach – a pure UBP scheme or a hybrid approach.

The pure approach -is based on a linear function between the metric and the price. Customers pay only for what they use. This approach fully aligns price and value and provides for maximum flexibility. It is the truest form of UBP (we see it more commonly in the adtech and fintech industries) but its main drawback is the lack of predictability.

The hybrid or tiered option – is where the price is based on a steps or tiered function. These tiers allow for a set payment for a pre-defined usage cap. This option offers lesser alignment between price and value but provides higher levels of predictability. Customers still have the flexibility to choose the appropriate tier for their usage and can easily shift between one tier to the next. Solving the predictability problem however unveils another problem – what happens if the customer overuses or underuses the tier that they chose? When choosing the hybrid approach companies must choose an accompanying overage and underage approach. Dealing, respectively, with over-usage and under-usage.

Overage approaches vary based on how customer centric or punitive they are. They aim to balance between encouraging and incentivizing customers to move to higher usage and higher-cost tiers while making sure customers don’t spend on what they don’t need. They are not mutually exclusive and can be combined. Different approaches include doing nothing and maintaining original rate, providing a buffer before overage charges are imposed, balancing credits across periods, automatically upgrading customers to higher tiers, imposing higher pay-as-you-go rate, throttling customer usage.

Companies must also decide how to approach underage. This situation is less discussed, but it has significant implications not only for customer experiences but also for revenue recognition and operational issues (which we’ll address later on). Similar to overage, several approaches emerge for underage, which can be deployed separately or in tandem. They range from highly customer centric – crediting customers account for portions they didn’t use – to the least customer centric – charging for the unused portions.

Our next and final post of this series will cover operational and organizational questions that must be addressed when deploying UBP, especially in situations of transition from traditional subscription.

See All Parts

Usage Based Pricing What Is Usage-Based Pricing and Why Should You Care About It

Usage Based Pricing What Is Usage-Based Pricing and Why Should You Care About It  Usage Based Pricing Aligning on Terminology – What Is UBP

Usage Based Pricing Aligning on Terminology – What Is UBP  Usage Based Pricing Why and When UBP Outperforms Traditional Subscription

Usage Based Pricing Why and When UBP Outperforms Traditional Subscription  Usage Based Pricing Deploying UBP – Operational and Organizational questions

Usage Based Pricing Deploying UBP – Operational and Organizational questions  Usage Based Pricing Sales Compensation – UBP Edition

Usage Based Pricing Sales Compensation – UBP Edition