Usage-Based Pricing (UBP) is on the rise. Over the past few months, since publishing our previous blogs, we’ve seen more stakeholders join the UBP bandwagon. Investors and founders alike are diving deeper into the benefits of UBP, and a growing number of early stage companies are adopting this pricing approach.

This adoption has led to a new set of questions and challenges that we confront daily at Viola Ventures. Top of mind to many founders, whether they’re looking to grow the business or to raise their next round, is what to track and how to communicate it. In other words, it seems that everyone is grappling with the question of what should be the Key Performance Indicators (KPIs) for early stage UBP based companies.

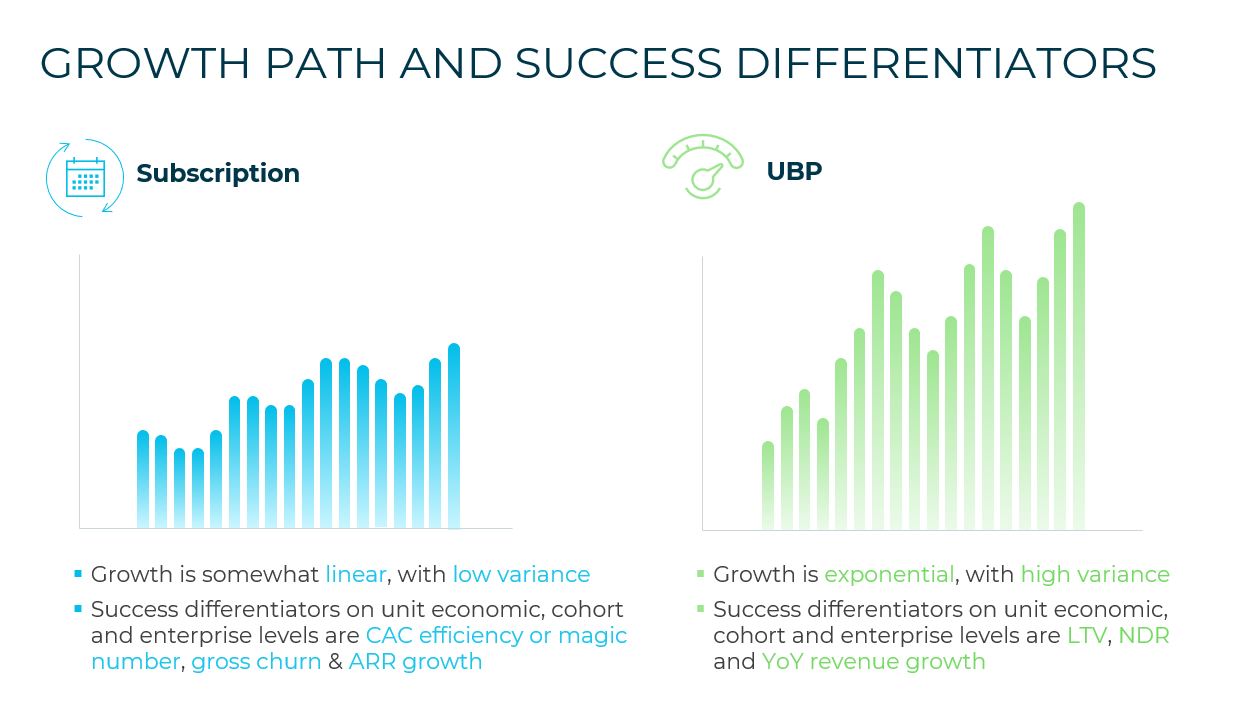

As we’ve mentioned in the past, UBP is a powerful lever to deliver growth, which is highly favored in today’s market. UBP based companies show very different growth paths than traditional subscription companies and their success differentiators are quite different. As such, these companies need to optimize under different sets of constraints and goals. For instance, on a unit economics level, favoring growth over efficiency leads UBP companies to focus on growing LTV rather than optimizing CAC. Similarly, on a cohort level, gross churn on its own is less important to UBP companies compared to Net Dollar Retention.

That being said, from 30,000 feet, on a high level, based on our experience, both UBP and subscription companies should track, communicate and plan very similar KPIs, with very fine differences.

On a high level, there should be 4 categories for KPIs: (1) topline growth, (2) expansion and retention, (3) customer growth, and (4) efficiency. For each of these groups, early stage companies should communicate what’s the current value for a selected KPI and what is the trend.

The main difference between subscription and UBP lies in the top-line growth KPI. As their name suggests, subscription companies enjoy Recurring revenues from subscription, and thus should focus on Annual Recurring Revenue or ARR as their leading KPI. UBP companies, on the other hand, usually do not have any recurring contractual commitments. The revenue of UBP companies is Reoccurring on an annual basis, which means that customers increasingly use their product or service but without a long-term formal contractual commitment. Thus, their leading KPI should simply be Revenue. We think that irrespective of their pricing choices, companies should measure and communicate, Net Dollar Retention for expansion and retention, number of customers and their ACV for customer growth, and gross margins or LTV/CAC calculations to showcase unit economics and efficiencies at scale.

As an analogy, showing top-line growth or revenue, is equivalent to proving that “the dogs are eating (and paying for) the dogs’ food”. Showing expansion and retention is equivalent to proving that dogs are eating more dogs’ food, and that few dogs have opted for a different type of dog food. Customer growth can show that more dogs are eating dogs’ food and buying it in bigger bags. Efficiency shows that our dog food machine is profitable in its core.

As an example of this high-level parity, we look at two leading SaaS companies from the two camps – Snowflake as a representative of the UBP camp and Okta as a representative of the subscription camp. We present here extracts from quarterly results presentations. It is important for us to show that overall, the KPIs are quite similar, apart for the ARR/revenue distinction mentioned above.

Tracking and setting targets for Revenue, NDR and unit economics for early-stage companies isn’t easy. We don’t question that.

Yet, it’s very important, nonetheless. Choosing a pricing methodology, and aligning on the usage metric, are not enough. As we all know, one of the most important hurdles young companies need to surpass is proving product-market fit. Initial revenue is a required step to show that. Top-line growth or Revenue is the product of price, pricing, and usage. To prove product-market fit, startups need to prove the value they create through the price they command and the usage that occurs. The other KPIs are equally as important, yet for some it’s easier to set targets than for others.

As such, we recommend using a hypothesis driven methodology. For example, one of the key challenges in the Revenue KPI is aligning on a price level. We suggest that companies start with hypothesizing on the appropriate price level, based on the value customers receive and based on other alternatives in the market. This should be a data driven approach. Then, using the price assumption, we encourage all companies to test, plan and iterate. It’s more than acceptable to start with price and other KPIs at a certain level and work with a plan to improve them over time.

The bottom line is that every plan should have clear KPIs for business traction, expansion and retention, customer growth and efficiency. These should act as beacons for both growing the company and raising its next round of funding.