2021 marked a significant boom in the Israeli fintech ecosystem, totaling $4.5B in fintech funding, setting a record high. Not only was this greater than the previous 3 years combined (with a 136% increase from 2020), but funding more than doubled in 2021 alone.

Israeli fintech growth was disproportionate – while total funding by Israeli tech companies leapfrogged in 2021, fintech’s share increased to 17% of total VC funding.

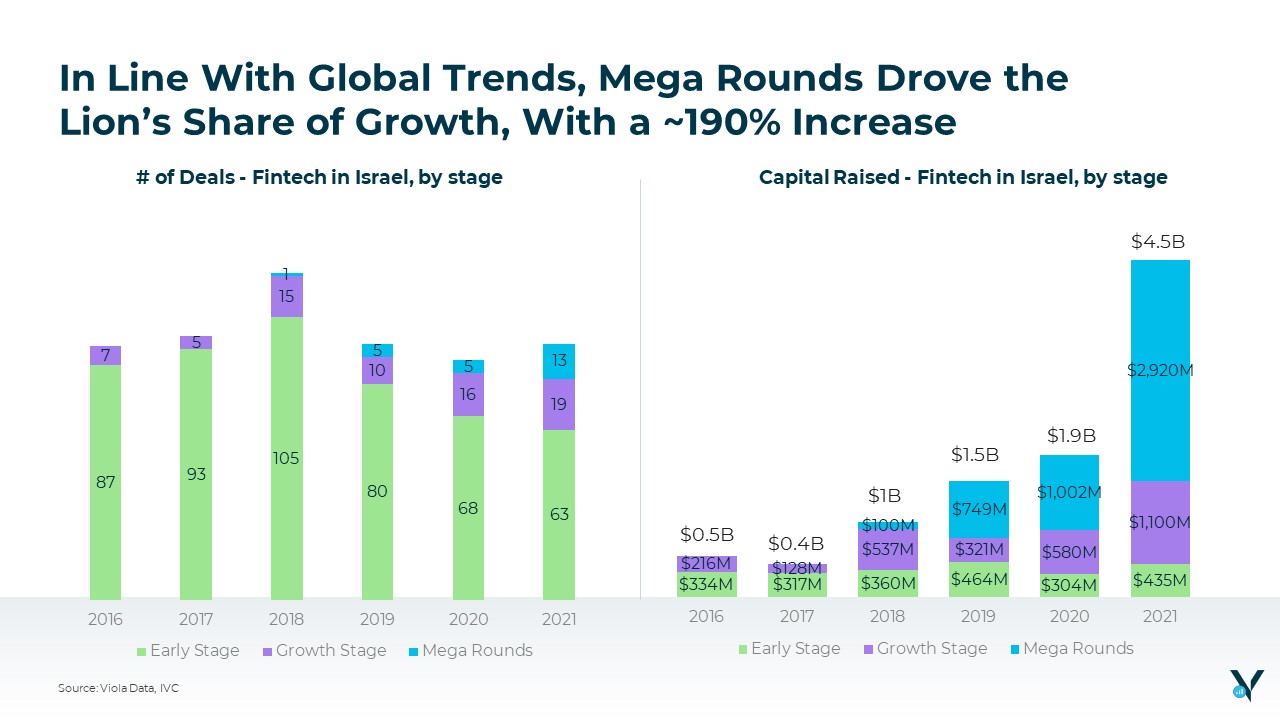

In line with 2021’s global trends, Israeli mega rounds drove the lion’s share of growth in the fintech space, with a 190% increase in capital raised. Early & growth stages median deal sizes have doubled in 4 years, while mega rounds more than doubled during the same period.

It’s interesting to note that there are distinct sub-categories within mega rounds in terms of size: Rounds of above $100M and rounds of above $250M. The latter may turn into potential future Israeli decacorns, including Tipalti, Celsius, Honeybook, and Next Insurance.

Furthering Market Maturity

In looking at 2021’s market trends and report, we can see that the Israeli fintech ecosystem is maturing. 17% or 1 out of 5 Israeli unicorns are either fintech or Insurtech. Companies like Pagaya, Tipalti, Payoneer, eToro, Honeybook, Lemonade, Hippo, and Celsius, just to name a familiar few.

Furthermore, 23% of the most significant IPOs in 2020 and 2021 were Israeli fintech and Insurtech companies. Companies like Payoneer, Riskified, Hippo, Lemonade, and Nayax expanded their global reach.

More specifically, in 2021, Israel fintech companies went from targets to acquirers – solidifying their presence as category leaders in the global market through acquisitions of both Israeli and non-Israeli companies. 2021 saw 10 M&As, and we believe this trend will continue in 2022 as well.

Israel’s High-Traffic Segments

Looking at Viola’s fintech map, we identify four prominent segments in the Israeli ecosystem: Insurtech, Payments, Trading and Investing, Lending and Financing.

Breaking down the “traffic” on the map – which sectors grew with newcomer companies and which sector had the highest number of companies that pivoted or closed – we see a high emergence activity and traffic in Insurtech, Crypto, and Financial Management – taking the lead as the top upcoming fintech segments driving innovation. We can also see further evidence of Israel’s market maturity in both the Payments and Regtech segments.

Most notably, Payments comprised 17 exits from 2019 to 2021 – which testifies to the maturity of this space.

A Closer Look

Continuing our deep-dive analysis into fintech segments, our report takes a closer look at each of the segments mentioned above – let’s focus here on 2 of the most interesting ones: Crypto and Financial Management.

Crypto – Growing 9X in 2021

Crypto by far experienced some of the most dramatic (and exciting) growth within the Israeli fintech market – driven largely by mega rounds. With over $1,055M raised in total capital, crypto experienced 9X the growth in just 2021 alone – yes, you read correctly.

New companies emerged on the map within sub-segments Defi (3), Payments (4), Security and Infrastructure (4), Tokenization (2), Wallets and Exchange (2) – with unicorns Celsius (Defi), Starkware, and Fireblocks (Security and Infrastructure) leading the growth driven by mega rounds, these 3 alone accounted for $968M raised in total capital.

Financial Management – from Payroll to Personal finance

Like Crypto, the Financial Management segment saw strong growth within the fintech market – most notably in sub-segments HR & Payroll. Totaling $952M alone in funding raised for HR & Payroll. Financial Management saw itself become a hot segment as well in 2021 – with companies Deel accounting for $581M raised and Papaya Global accounting for $350M!

Other interesting developments – 5 new companies emerged, accounting for 30% of new companies in the FP&A and Accounting segment. Personal (3) and Tax Management (2) then followed accounting for 29% and 24% of new companies, respectively, within the Financial management segment.

Looking Forward

Looking to 2022, we expect the Israeli fintech market to stay hot, especially around the growth engines and category leaders mentioned above. Yet surpassing the records 2021 put in place will be challenging and require external market catalysts. Rather, we expect to see Israeli fintechs increasingly engage in M&A following 2021’s flurry of mega rounds.