Amit Ashkenazi is VP Business Strategy at Fiverr, and also formerly a Partner at Viola Growth. This post was written during his tenure at Viola.

There’s been so much chatter in the blogosphere (and beyond) about whether or not we’re in the midst of an investment bubble, that arguably, the topic has long been exhausted. But with all sorts of talk being rekindled recently about the freeze in private markets and the growing restraint in investments and company valuations – the debate over when the bubble is going to burst (or whether it exists at all) is still churning. That’s why entrepreneurs raising funds for their startups need to tread very carefully, and allow their sensibility to guide them rather than their ego.

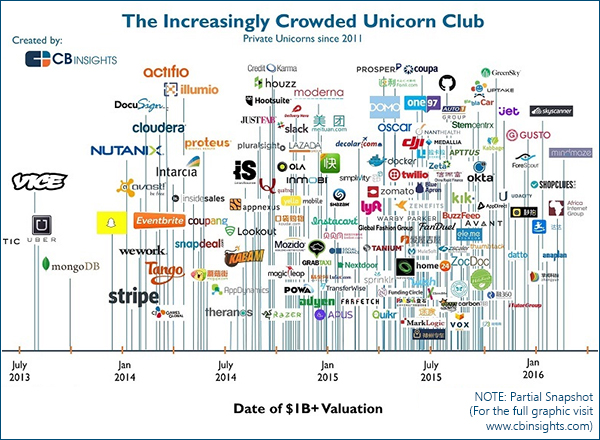

We witnessed the peak of (unreasonable) valuations back in mid-2015, when literally all of our deal-flow companies raised B or C rounds at pre-valuations of between $200-300 million. Checks and round sizes also reached an all-time high, and it basically seemed like any company with prospects of achieving an exit at less than a “unicorn” valuation (at least $1 billion) was considered a tremendous failure. The rise in the number of unicorns was starting to convince founders and entrepreneurs everywhere that unicorn-status is easily achievable. So much so, that its rarity was being questioned to the point that it might arguably warrant a name-change to an animal that isn’t quite as elusive (like “donkey”, maybe?).

Could the over-crowded Unicorn landscape warrant a name change for the no-longer-so-rare valuation status (like “donkey”, maybe?)

Take a look at this popular CB Insights graphic from last year, depicting the “increasingly crowded unicorn landscape”:

Doesn’t really make sense, right?

Nevertheless, despite this bewilderingly fertile fairyland of unicorns, professional investors want to continue deploying their money, so as a result, we’ve seen a rise in highly structured investment deals. Since anything beyond a significant up-round has come to be considered a failure, and no investor (or company) wants to be seen as a failure, in order for investors to reach the grand valuations that companies are shooting for, they’ve had to add some “goodies” to the investment terms so that when the time comes for an exit they are compensated with more than “just” their share in the company. This effectively reduces the valuation of the company and bridges between the valuation on paper with the “actual” value of the company.

These investment structures manifest in a variety of ways, for example:

![]() Multiple liquidation preference – which allows the investors (in preference to any other shareholder) to receive more than their original investment in downside cases.

Multiple liquidation preference – which allows the investors (in preference to any other shareholder) to receive more than their original investment in downside cases.

![]() Participating preferred shares – which allow investors to get their investment back (at least, if not more) and then share the remaining proceeds with all the other shareholders as well.

Participating preferred shares – which allow investors to get their investment back (at least, if not more) and then share the remaining proceeds with all the other shareholders as well.

![]() Warrants – these boost the investors’ returns by providing them with upside in the case of an exit at the higher valuation.

Warrants – these boost the investors’ returns by providing them with upside in the case of an exit at the higher valuation.

As a founder, you should bear in mind that raising a significant up-round with a heavily-structured deal is a double edged sword. On the one hand you’re getting your desired valuation on paper, but there are also some negatives to consider:

![]() Heavy investment structures increase the likelihood that management will take unreasonable risks in order to increase to company’s value significantly, because since they are usually holders of ordinary shares (as opposed to preferred shares), this is the only chance for them to make a real fortune. This is definitely not something that investors wanted to promote as it could lead to a significant misalignment of interests between all the stakeholders.

Heavy investment structures increase the likelihood that management will take unreasonable risks in order to increase to company’s value significantly, because since they are usually holders of ordinary shares (as opposed to preferred shares), this is the only chance for them to make a real fortune. This is definitely not something that investors wanted to promote as it could lead to a significant misalignment of interests between all the stakeholders.

![]() Raising money in a valuation that is detached from the underlying (i.e. realistic) value of the company exposes it to a future down-round and activation of downside protection articles, which is very unpleasant and might leave you as an ordinary shareholder with almost nothing.

Raising money in a valuation that is detached from the underlying (i.e. realistic) value of the company exposes it to a future down-round and activation of downside protection articles, which is very unpleasant and might leave you as an ordinary shareholder with almost nothing.

![]() If the company decides to go public, usually the investors must waive all of the “extras” and stay with their simple pro-rate share in the company. This might cause them to vote against an IPO even if it might be in the company’s best interest.

If the company decides to go public, usually the investors must waive all of the “extras” and stay with their simple pro-rate share in the company. This might cause them to vote against an IPO even if it might be in the company’s best interest.

Some companies, of course, are genuinely promising and deserving of the significant upside in their valuation, where a simple investment structure (with non-participating 1x preference on the investment) is sufficient, and would allow investors to protect their investment in the worst case scenario. This mechanism is best for the alignment of interests between all shareholders of the company, which is a very healthy thing for the company, both in bad times and good (exit or IPO). Once the company’s valuation passes the amount invested in it, all shareholders interests align and everyone is entitled to their pro-rata shares.

But for such a mechanism to make sense, the company’s valuation must truly reflect its actual results, achievements and market position or opportunity. This structure is much more aligned with public market investments where everyone holds ordinary shares.

When you launch a new company and start shopping around for funds, try to keep the investment structure as simple as possible from the beginning, and aim to get exactly what the business is worth with no unjustified premiums, because the consequences of “heavy” structures can eventually snowball into an outcome that will ultimately hurt all the stakeholders.

There’s a great example of aiming for a reasonable valuation in the second season of HBO’s popular TV show Silicon Valley (highly recommended if you’re either an investor or someone who works in the startup scene). Pied Piper (the startup in the show which the main characters create and then grow) is presented with a term sheet that ups the company’s value to $100 million (before any revenues!). In this episode, the Founder of Pied Piper is advised by his seed VC investor not to take the deal because it’s a “classic runaway valuation”. “If you have a down round” (in the future), she explains, “you are f**ked. You want to start at a realistic valuation and grow at a realistic pace.” Eventually, the CEO goes back to the investors and tells them that he’ll take the investment only if the valuation is reduced to $50 million (“I think this is more reasonable”).

As Leonardo da Vinci said, “Simplicity is the ultimate sophistication”, and when it comes to building a company’s valuation while also aligning with the shareholders’ interests, it couldn’t be truer.

More posts by Amit Ashkenazi:

![]() From Don Draper to Sheldon Cooper: The Transformation of CMOs

From Don Draper to Sheldon Cooper: The Transformation of CMOs

![]() Why spending big to grow a company that’s based on shaky unit economics is a lousy idea

Why spending big to grow a company that’s based on shaky unit economics is a lousy idea

![]() Everything as a Service (EaaS): Why eventually we might not need to “own” anything

Everything as a Service (EaaS): Why eventually we might not need to “own” anything

![]() Change Agents and how they impact new technologies

Change Agents and how they impact new technologies

![]() Love thy Competitor: Why competition can be a good thing for startups

Love thy Competitor: Why competition can be a good thing for startups

![]() What your approach to recruiting top talent says about you and your company (and why it really matters)

What your approach to recruiting top talent says about you and your company (and why it really matters)

![]() Seeking a strategic investor for your company? Here’s what you need to know

Seeking a strategic investor for your company? Here’s what you need to know