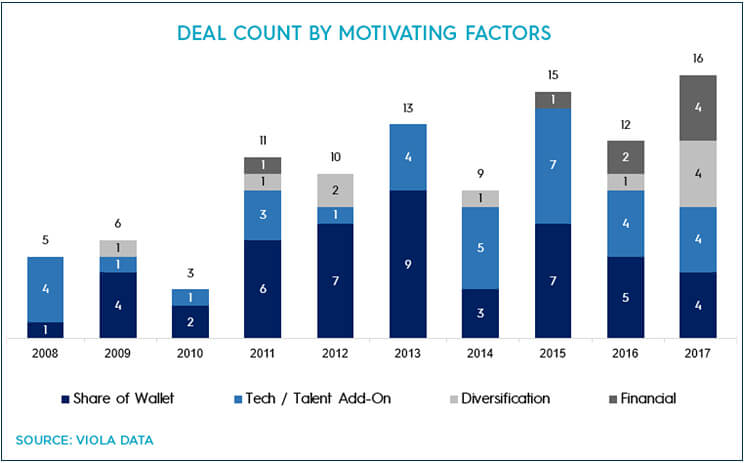

As international interest in Israeli companies continues to grow and more capital is committed to its innovative tech sector, Israel’s M&A market has become increasingly active in recent years. In 2017 alone, Israeli tech saw a record number of 16 deals above $150M.

After evaluating 100 acquisitions of Israeli companies for $150M+ since the beginning of 2008, we have observed that Israeli tech is experiencing a diversification in buyer motivation, geography and check size.

Our research has led to some interesting insights on two important questions:

1. What are the motivations driving acquirers to target Israeli companies?

2. What are the most significant trends we are witnessing in the Israeli M&A market?

Age of Diversification

In general, exits in Israeli tech can be characterized as either Strategic or Financial. On the strategy side, possible motivations include Share of wallet (an increase in the customer’s willingness to pay by adding additional/complementary products); Tech/Talent Add-on (acquiring cutting edge technology and/or talent in related fields) and Expansion of Addressable Market (entering into new markets). On the other side, the primary driver of Financial buyouts is generally to maximize deal-based ROI.

Over the past decade, Israel had become accustomed to US based tech giants such as Cisco, Microsoft and IBM coming to shop in the Israeli tech ecosystem. Their primary motivations have historically been talent acquisition (in some cases opening R&D centers in Israel), proprietary technology, and to expand their portfolios with complementary solution. In recent years, however, we have identified a dramatic diversification, both in motivation and in the identity of the buyers.

The perception of Israel’s M&As landscape is shifting from that of a destination for tech/talent or share-of-wallet acquisitions to one that’s recognized for building companies with market presence. This trend demands a level of operational maturity within the target companies. While the classic acquirer has traditionally focused on technology, the new buyer is now looking for more sustainable business models and multidisciplinary capabilities.

3 main characteristics of diversification in Israel’s M&As landscape

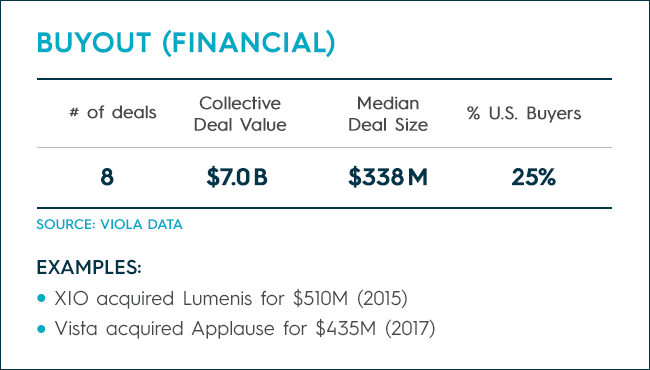

1. Emergence of the global PE investor

Arguably the biggest trend we have noticed is the emergence of international private equity investors searching for investment opportunities in Israel. Out of the 8 total buyout deals valued at $7B overall – including Lumenis (acquired by XIO in 2015 for $510M) and Applause (acquired by Vista in 2017 for $435M) –4 occurred in 2017. These potential buyers look for substantial market share, business models and multidisciplinary capabilities. They want to see a company’s ability to position itself globally, build strong partnerships and execute their go to market strategies with an emphasis on profitability.

2. Non-US acquirers

The US dominates Israeli M&A activity and accounts for 70% of the total deals, 94% of which are strategically driven. But, in terms of trends, we noticed that much of the recent increase in exits is owed to non-US acquirers.

Non-US acquirers made more deals in the last 3 years (13), than in the 7 years prior (11). Furthermore, these RoW (rest of world) deals tend to be larger, with the median size for RoW at $325M compared with $249M for the U.S. median.

In terms of financial (PE) acquisitions – non-US acquirers are responsible for 6 out of 8 buyouts, with UK-based firms accounting for 50% of the activity.

3. Higher price tag

With the demand for broader capabilities and larger operation comes a higher price tag. We noticed the median deal size rising from $240M in the 5 first years to $320M in the last 5 years.

Since 2015, we have also witnessed a new phenomenon of mega deals, as evidenced by the greater number of deals which are significantly above the median line. The trend has continued in 2018 with 3 mega deals already taking place (Orbotech, NDS, Datorama and Mazor Robotics).

Target Industries

MedTech, semiconductors, media, cybersecurity and enterprise software account for 64% of the 100 exits we reviewed. The fastest growing industry since 2008 has undoubtedly been cybersecurity, while MedTech appears to be slipping from the top spot. Industries that experienced low levels of buyer interest (to date) include automotive, gaming and AgTech; however, we expect the first to attract greater interest as Israeli startups catering to the autonomous driving field continue to scale.

Since 2012 (67 deals in total), the security, enterprise software and media sectors have taken the lead as target industries, while other sectors such as communication, semiconductors and MedTech have slowed down.

The three Primary motivations behind the strategic M&As

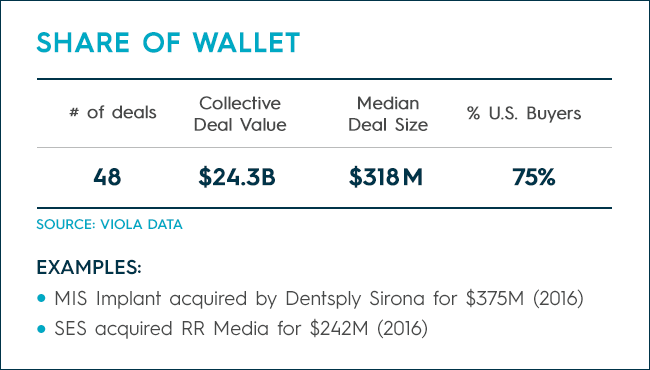

1. Share of Wallet

This is the number one reason companies look to Israel for inorganic growth. That being said, although it represents a large chunk of total acquisitions –constituting 60% of exits from 2008-2012 – this leading motivation has fallen behind other key rationale, accounting for only 40% of exits in the past 5 years. In other words, exits motivated by market share haven’t necessarily dropped, but rather exits tied to other motivations became more abundant.

Companies that come to Israel looking for higher market share are typically smaller and more cash-restricted. Their median EV is $9.8B at the time of the deal – the smallest of any motivation segment – compared to the median of $24.2B for all acquirers.

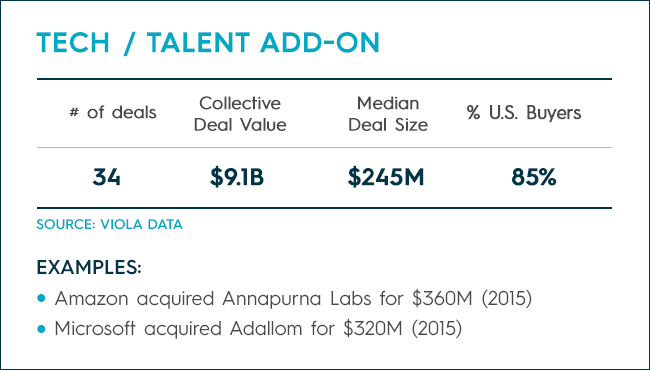

2. Tech / Talent Add-On

The second biggest motivation stems from the acquirers’ desire to enhance their products with proprietary technology, either through the technology itself or through the talent of the target. These acquisitions are usually in close proximity to the acquirer’s primary field, mainly in the semiconductors, cybersecurity and enterprise software sectors.

These acquirers – sometimes characterized as “Gorillas” quenching their hunger for new tech by looking at Israel’s jungle of startups – have traditionally been large, generally US-based conglomerates, that hunt Israel’s high-tech ecosystem for innovative and disruptive technologies. This is best demonstrated in the size of the acquirers that share this motivation, having a median EV of $105B at the deal date – by far the largest of any segment.

The majority of exits (~70%) of this type occur in the $200M-$400M range. This narrow range derives from the fact (which is unique to this category) that the price paid is usually irrespective of the target’s revenues, as the true objective is acquiring the specific technology or brain power.

3. Expansion of Addressable Market

The third motivation behind buying Israeli technology is “big moves into new markets”, or as we call it – Expansion of Addressable Market. These types of investments – intended to provide diversification by entering new domains – rarely occur in Israel, but when they do, they don’t go unnoticed and often inspire even bigger deals. The median deal size for diversification-type exits is the highest of any motivation at $380M.

Despite their historically low numbers, diversification deals appear to be on an upward trend, with 5 deals in 2016-2017, representing half of all deals in the last decade, 3 of which were made by non-US buyers.

Intel’s $15.3B acquisition of Mobileye in 2017, for example, sealed its foothold in the Automotive Vehicle field and constituted the largest exit in Israel’s history. Aside from this deal, Intel made 2 more acquisitions in Israel, both in order to diversify – Replay (3D video) and Telmap (mapping & navigation).

Conclusion

Israel continues to be a promising location for M&A with a record number of exits in 2017. Analyzing the main motivating factors shows that in the past, the primary acquisition driver was either Share of Wallet or Tech/Talent Add-on. However, we are witnessing a new wave of financial acquirers and an increased desire of companies to expand their market through acquisition of Israeli targets. This phenomenon, along with further non-US international interest, growth in deal size, and the emergence of mega deals, are indicative of the global market’s increased confidence in Israel’s high-tech ecosystem, and that big companies can definitely be built (and exited) in Israel.