It’s budget season and many companies are in the process of setting their goals for 2016. Whether a “correction” in the market will happen or the private market will continue to be bearish doesn’t really matter – it is quite clear that coming year is going to be focused on “healthy growth” rather than just “growth”. And if market dynamics change, investors might even want to see a path for profitability (god forbid)…

This requires a new look at the metrics that companies are trying to optimize. While most “SaaS KPI Guides” and investor blogs tend to highlight growth, I believe that companies approaching $10m in ARR should start looking at how efficient the organization is and what needs to be done in order to make sure that its growth is “healthy”.

Below I listed a few “efficiency KPIs” that we at Carmel have been using with our portfolio companies as we prepare for next year. The list is still a work-in-progress so any feedback or new ideas are welcome. One technical note though – all the KPIs are quarterly, so for any other time period, you should adjust accordingly:

Annualized Gross Churn

This is a very basic KPI that has been in existence forever, and is calculated as follows:

In the past two years, however, this KPI was somewhat abandoned and replaced with “net churn” (which includes expansions) and others. In terms of efficiency, minimizing gross churn is still the most cost-effective way to grow, even if new logos and expansion numbers are good.

Customer Acquisition Cost Ratio (CACR)

This is probably the best KPI for measuring the health of the entire organization. CACR is calculated as follows:

Many companies manipulate this calculation (only new logos CAC, Gross profit based calculation etc.). The truth is that any company could and should choose the calculation that best describes its business, but it should also keep it consistent so that it’s easy to see the progress trend. For more reading on the importance of CAC ratio, please refer to my earlier post here.

Sales Efficiency

While quotas for sales people stay pretty much the same across companies and range from $400k of ACV for low-ASP inside sales, to $1.4m ACV for enterprise accounts, the compensation of the quota-carrying sales people changes significantly based on geography, experience etc. A very useful metric to test the cost-effectiveness of those sales people it to divide their annual quota with their base salary as follows:

Numbers should range between x8-x10 as a minimum in order for the sales department to be considered efficient. So, an inside sales rep earning a $60k/year base salary should have a quota of $480-600k (at least).

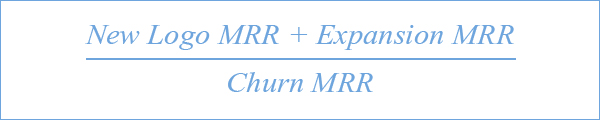

Quick Ratio

This is one of the easiest yet the best KPIs for measuring the go-to-market efficiency. Since most of the sales & marketing people are invested in attracting new logos, it is important to see that this effort is not undermined by high churn. The quick ratio is therefore measured as follows:

While many thought leaders in SaaS recommend aiming for a ratio of 4 or greater, I tend to be more aggressive on this specific KPI and push for a ratio of 5 as a minimum.

ARR/Employee

There is a strong correlation between a company’s ability to become profitable and the number of its employees, so the ARR/Employee metric is a good indicator for this. Here, numbers tend to vary a lot between different kinds of companies, but for a steady growth rate, it is important to see that this KPI keeps improving. It is easily measured as follows:

To summarize, as the SaaS market matures and companies need to operate under changing market conditions, additional KPIs need to be introduced to measure the efficiency of the operation. As you prepare your 2016 budget, it’s a great opportunity to start adopting some of the above KPIs or come up with new ones.