As we increasingly adopt technology and take control of our financial lives via smartphones and savvy front-end applications, we tend to forget about a demographic who stands to gain the most but might feel left behind in an increasingly digital world. A demographic where we all (fingers crossed) hope to find ourselves one day. The elderly population.

The many benefits of fintech and digitized financial services are geared towards the underserved and underbanked who have previously lacked the physical infrastructure for robust financial services.

In this two-part blog series, we will outline some of the challenges as well as the countless opportunities for Fintechs in this space.

Note that although we often refer to the UK market as an example, and while there are significant differences across geographies, we strongly believe that these challenges and opportunities are global.

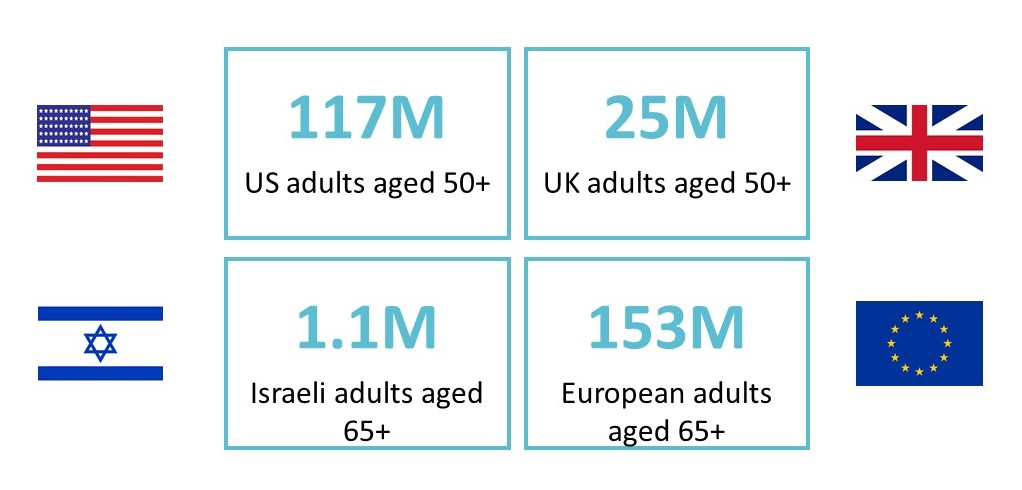

Elderly Population: Already Huge, Still Growing….

Sources: Statista, PRB, US Census

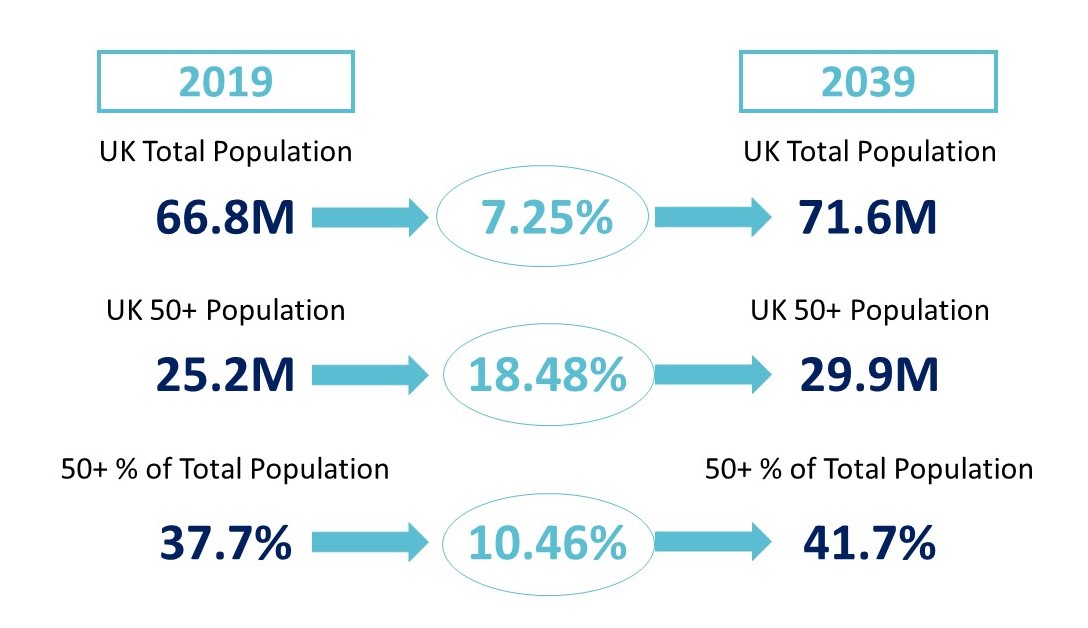

The world’s population is a lot bigger today than it was 50 years ago, and a lot older, too. Between 1999 and 2019, while the UK population grew by 8 million people, the 50+ population grew by 6 million people. Over this 20-year span, the ratio of adults aged 50+ to the UK population grew by an astonishing 15%.

Thanks to increased life expectancy, reduced mortality and stable fertility, we only see this trend growing in the next 30 years. In fact, 70% of the UK’s population growth to 2039 is expected to be in the 60+ age group. Bottom line – this segment cannot be overlooked.

Extreme Inequality in Wealth

According to the Brookings Institute, seniors are the wealthiest age cohort in the world, together with older professionals (45-64 years). They hold disproportionally higher percentage of household wealth and spend. However, looking at the US’s Wealth Gini of 0.85 — the numbers are skewed to the wealthy. In the UK, seniors are no better off and are suffering the worst poverty rates in Western Europe – 5% of the elderly population lives in severe poverty, up from 0.9% in 1986. Professor Bernhard Ebbinghaus, of the University of Oxford, attributes this rise to Britain’s failing State Pension System.

Pensions: State Pensions are Unsustainable

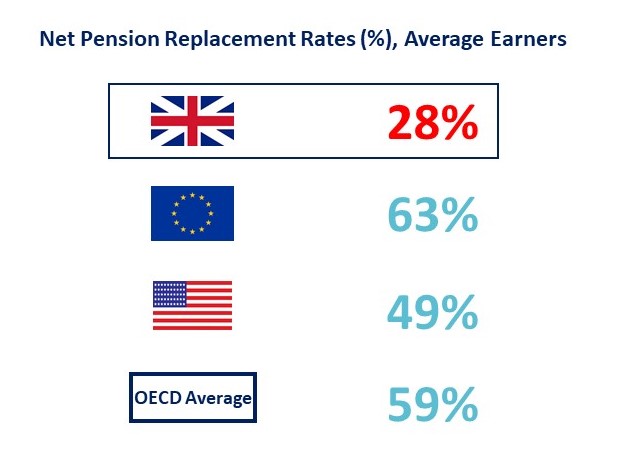

Pension structures, income sources and taxes are not uniform across all countries, making it difficult to compare pension systems. Nevertheless, public transfers are low in many countries: only 42% in the US and the UK, compared to 75% in France and 70% in Spain.

Perhaps the best metric to run comparisons on pension systems is the net replacement rate (NRR), representing disposable income in retirement from mandatory public and private pension schemes relative to disposable income when working. While NRR is globally low, in the UK and the US, pensioners are suffering the worst deals of most OECD countries with a meager 28% and 49% respectively, compared to the 59% OECD average.

With the exception of increasing state pension age, governments have limited means in their toolboxes to address this problem (eg. the UK will gradually increase pension age from 65 to 68 during the next 7 years).

This situation will only get worse as the cost of providing state benefits becomes greater than the money being collected in National Insurance Contributions (NICs). It is estimated that the funds may run out completely by 2033, described by the World Economic Forum as a part of the “global timebomb” of over $400T!

Rise of Defined Contribution Plans

Alternatively, governments are encouraging the use of private pensions schemes (aka “defined contribution”) where all employers are mandated to automatically enroll eligible employees in a workplace pension scheme. On the one hand, these regulations increase the rate of retirees with any pension plan in place, however, it usually results in lower income from these pension plans.

Working Well into Retirement Age

Shrinking pensions, combined with increased ability and willingness to work as a way to maintain lifestyle and mental health, are increasingly pushing retirees to work well over the age of 65. This means that there are more people than ever before looking for a job and requiring professional training over the traditional retirement age.

Source: UK Office for National Statistics

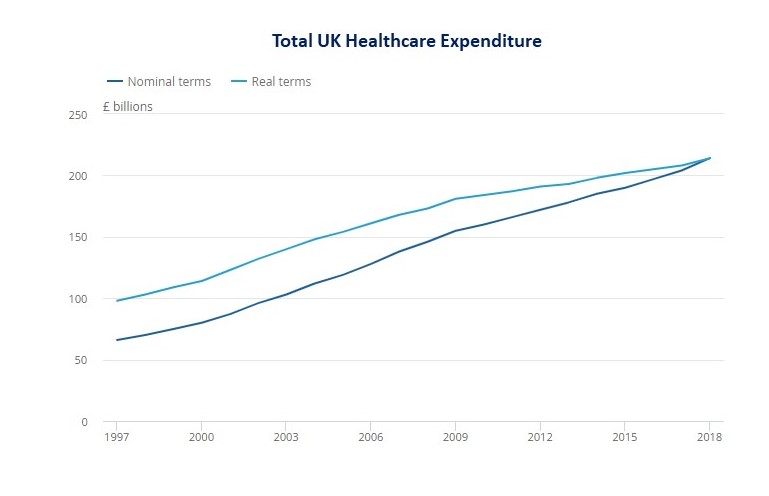

Increasing Healthcare Costs

As adults live longer, and with the constant increase in the cost of care, spending on healthcare doubled between 1997 and 2018. With fewer income sources, this poses a challenge for retirees and their families and requires alternative sources of income to finance these costs.

Real Estate as an Untapped Source of Wealth of Pensioners

As we already discussed in previous blogs, urbanization and other factors drive a significant increase in real estate prices. As a result, about 50% of a retiree’s accumulated wealth is in an illiquid asset. This mismatch to the required cashflow during retirement calls for innovative solutions.

Source: UK Office for National Statistics

Elderly Population is Community-Oriented, More Susceptible to Internet Fraud

Elderly people are more inclined to feel safe in their neighborhoods and help their neighbors when compared to their younger counterparts. We can assume the same is true online: seniors are likely to engage in online communities. However, they are also more likely to fall victim to online fraudulent schemes. In 2020, American seniors lost $1bn falling victim to internet fraud – a $300M increase to 2019.

Deep in Debt Even at Retirement

Contrary to what may be expected, debt is not only a young person’s problem. In the United States, a Congressional Research Service report found that the percentage of elderly households with any type of debt increased from 38% in 1989 to 61% in 2016. The amount owed jumped almost fourfold to $31,000. Moreover, the New York Federal Reserve reports that more seniors are at risk of over-indebtedness in retirement due to their heightened likelihood of having debt.

Opportunities Abound

With low retirement savings, larger expenses driven by life expectancy, rising healthcare costs and still significant debt, there are numerous opportunities to provide innovative, tech-driven Fintech solutions to the ever-growing senior population now in their golden years.

In our next blog, we will dive into some of the prominent opportunities for this sector and highlight some of the companies pioneering innovative solutions.

In the picture: Our brave investment team, Tomer Michaeli and Adam Shalem, trying to imagine how the future of fintech will look like – for them 🙂