Over the last year, we’ve delved into Generative AI, engaging with founders, portfolio companies, and corporate partners to explore its potential. Generative AI is a dynamic space from many aspects and it has many unknowns. Yet, we are starting to see emerging opportunities, which are suitable for startups, to disrupt major markets using this groundbreaking technology.

In this post, we will outline global trends in Generative AI, where Israel fits in, and what we at Viola expect to see next for the Israeli Generative AI ecosystem.

Generative AI: Bottom-up adoption with substantial barriers still persisting

In their recent report, Gartner positioned Generative AI at the peak of the hype cycle. However, unlike previously hyped technologies, in this case, the commercial value is clear.

We’re seeing impressive productivity gains in software development, sales and marketing, internal communication, and knowledge management in portfolio companies and enterprises. The usage of Generative AI tools is driven by bottom-up adoption by employees using free or low-fee tools. Companies empower employees to use Generative AI tools by defining supportive policies.

Moreover, Generative AI shows value quickly in the intersections with Traditional AI. On top of the interactivity Generative AI offers, it also empowers Traditional AI in predefined narrow use cases by leveraging new capabilities and unstructured data. These properties are already being implemented. Our computer vision portfolio companies 4M Analytics, Taranis, and Lightricks are introducing Diffusion Models into their tech stack, thus pushing accuracy and breadth of scope to new levels.

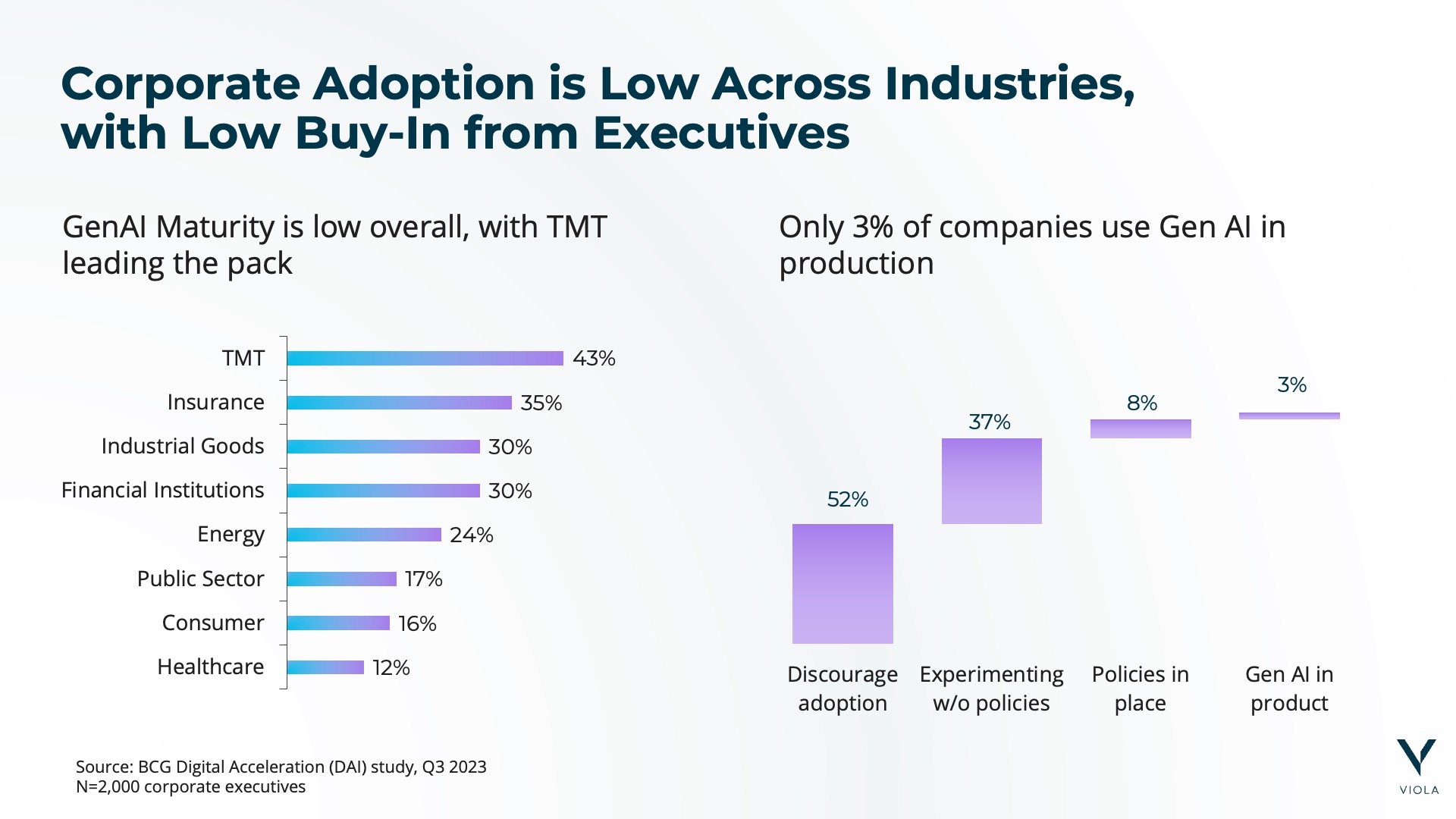

However, corporations are taking longer than expected to show deep adoption of Gen-AI – especially in their core products – due to 5 barriers: Security, privacy, intellectual property, performance, and cost.. Corporate-grade Generative AI tools like GPT 4.0 Enterprise and custom LLMs, like Anthropic is building for a Korean Telco will go a long way. Open AI has underscored this commitment by announcing a focus on tailoring LLMs to corporate needs through professional services, highlighting the increasing importance placed on aligning Generative AI models with corporate requirements.

THE IMPACT ON GENERATIVE AI FOUNDERS: Israeli startups focused on enterprise applications and Infrastructure solutions should consider the enterprises’ slower adoption pace and market immaturity when planning their roadmaps.

AI Cloud is the next platform shift

We witnessed how cloud-enabled software and later microservices led to a significant cost reduction in software development – democratizing software. We believe LLMs and Diffusion Models will do the same for AI capabilities.

Cloud Service Providers (AWS, Azure, GCP), AI Model Providers (Open AI) and Developer Platforms (Hugging Face) are forming a new technology ecosystem that enables innovators to design, build and deploy AI stacks at a fraction of the cost, time, and effort. The new AI-tech stack will make AI capabilities accessible using APIs, predefined code libraries, specialized models, and AI Agent workflows.

Unlike previous platform shifts, the AI Cloud revolution will materialize fast due to significant capital and brain power investments. 60% of global VC investments in Generative AI are concentrated in only sixteen startups that are driving this platform shift. These same organizations have attracted the most cutting-edge AI researchers in the world.

THE IMPACT ON GENERATIVE AI FOUNDERS: AI application startups should consider that competitive moats will shift from technology and algorithms towards superior product and GTM capabilities. AI Infrastructure startups should consider their positioning to win CSPs, AI Model Providers and Developer Platforms.

The Israeli Generative AI ecosystem is exhibiting some signs of delay, as the launch of chat.gpt 3.5 in November 2022 has yet to generate a significant investment uplift locally. This can be explained by the general local slowdown of VC and economic activity. Another reason for the relatively slower deployment of Generative AI capital is related to Israel’s competitive edge – focusing on categories that have yet to materialize. The war in Q4-2023 led to a further slowdown of tech investments.

Nonetheless, Israel is the 3rd largest generative AI VC ecosystem globally. Despite the war in Q4/23, Generative AI investments are set to break records during this quarter, especially due to major rounds of vertical AI solutions, e.g., Eleos Health raising a $40M series B and accounting autopilot Black Ore raising $60M, the largest seed round for an AI application company globally.

Over the past decade, Israel has developed a unique know-how to build and bring to market vertical AI solutions. Some examples of such category leaders are Pagaya in Fintech, Lightricks in Consumer apps, Tomorrow.io in ClimateTech, and Immunai in Healthcare.

We are already witnessing the early winners of vertical Generative AI. Oddity – an Israeli beauty tech company utilizing Generative AI models to develop personalized cosmetics – went public during a relatively closed IPO window and has been outperforming its peers on both valuation and fundamentals.

Besides verticals, Israel has also developed some of the most prominent infrastructure and cyber security companies globally as part of the cloud and data revolution – Redis, Jfrog, Snyk, and Wiz, to name a few.

We believe that Generative AI will be no different, and Israel will breed vertical application and infrastructure category leaders. The nature of those categories requires significantly lower capital resources compared to LLM and Diffusion Model providers. Moreover, the slow enterprise adoption inhibits growth rates, making those categories natural laggers. This can also explain the lack of chat.gpt 3.5 related VC uplift in Israel. Nonetheless, like in the cloud revolution, vertical and infrastructure-generative AI category leaders will emerge, and many will have Israeli origins.

It’s hard to predict how this dynamic space will develop. Nonetheless, some trends are unfolding, and founders should consider them:

It’s hard to predict how this dynamic space will develop. Nonetheless, some trends are unfolding, and founders should consider them:

1. The Generative AI application layer is dissipating as SaaS companies continue introducing Generative AI into their core products. Founders should consider how to win incumbents best positioned to build out Generative AI add-ons.

2. Incumbents will dominate horizontal Generative AI applications. They own the data, have superior access to an existing client base, and it’s relatively easy to build Generative AI layers as product features. Horizontal Application startups may find fewer barriers to entry, an educated market, and a large TAM, but they will need to face severe competition, and differentiation will be challenging.

3. Horizontal AI applications that enhance or replace human-powered services will prevail in spaces where traditional SaaS and AI are lacking.

4. Vertical Generative AI startups will stand out and become sticky by providing deep industry-specific solutions. Moreover, they will justify higher ACVs and gain market share from generic horizontal solutions.

5. CSPs, AI Model Providers, and Developer Platforms will dominate the AI infrastructure. They are highly innovative, well-funded and well-positioned commercially. Moreover, Generative AI corporate adoption is top of mind for all three types of players.

6. The AI Infrastructure startup landscape is dense. To stand out, startups must come up with clearly differentiated solutions. We see room for such differentiation in data pipelines, observability, high-performance databases, and low-level AI chipset optimization solutions (Cuda killers).

What would it take for startups to succeed?

1. Founders with strong product capabilities who are customer-centric and able to adapt the product in a highly dynamic environment.

2. Significant technology on top of Generative AI capabilities, transcending simple API or UX innovation.

3. Flexible architecture supporting multi-models and leveraging AI Agents.

4. A clear advantage over CSPs and Model Providers in a less crowded space.

5. AI applications that have the potential to replace knowledge-based human services requiring real-time interaction.

6. Clear ideal customer profile (ICP) and competitive advantage over human services, SaaS, and AI alternatives.

7. Methodology creating dependencies and stickiness among users.

Are you a founder working on a Generative AI startup? We would like to hear from you. Please reach out to alexs@viola.vc