The following is a guest post by David Schapiro, Co-founder at Planck and former CEO of Earnix (both Viola portfolio companies).

As someone who has been living and breathing FinTech for the past decade in Israel’s blossoming FinTech industry – now considered to be among the world’s leading hubs for FinTech innovation – I have come to understand firsthand the challenges that face Israeli FinTech companies (and FinTech companies in general) and how it’s best to approach them in order to come out “on top”.

For over 30 years I have held a variety of business management and product leadership roles in global SaaS and enterprise software companies, and have been a part of some exciting journeys that involved growing startups and software companies in dynamic markets.

For the past decade, I have served as CEO of Earnix, whose cloud-based software solutions allow businesses to scale their modeling and predictive power to enable faster and better product and pricing decisions. We offer solutions that empower actuaries and analysts to generate the most accurate and robust predictive models. I’m very proud of the fact that leading banks and insurance companies worldwide now rely on Earnix solutions to produce consistent and measurable improvements in customer loyalty, profitability, and growth in order to deliver greater value to customers and higher profits to shareholders, year after year.

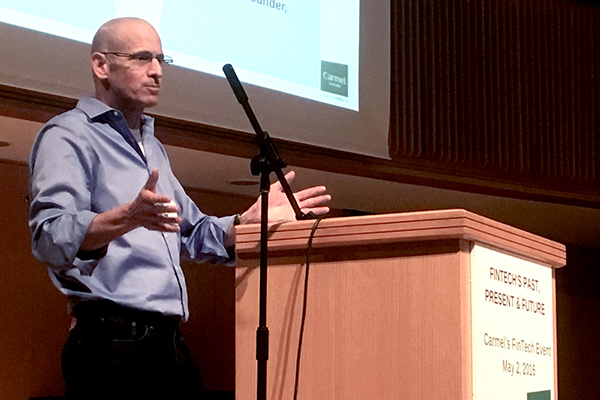

At a recent Viola FinTech Forum meetup titled “FinTech: Past, Present and Future” I presented my “Top 10” insights on what it takes to build a FinTech category-leading company. Here they are again, for the benefit of anyone who wasn’t present at the meetup and is planning on growing a FinTech startup of their own:

What does it take to build a FinTech category-leader?

1. Perseverance: Hang in there!

“Persevering” is relevant to entrepreneurs in virtually all industries, but it is especially respected by “the powers that be” in the world of FinTech. The fact that your message is consistent and your company remains stable year after year is extremely important in itself, particularly since in this industry, certain processes can take a very long time.

2. Become a Financial Services professional.

To maximize the chance of success for your FinTech startup, you need to morph into thinking like Bank or Insurance business executives.

I joined Earnix almost 10 years ago, after 20 years in the enterprise software industry, having worked mostly in analytically advanced, technological companies that were targeting the IT people and the CIOs of large enterprises. But at Earnix, I had to shift my sales focus from the IT side to the business executives, like the Managing Director or CEO of the insurance company, or the Head of Retail Lending in a bank, etc. These buyers are business people who are not interested in the technical side of the software, but rather are focused on solving problems that are specific to their business. This meant that we needed to learn how to speak the “business language” of banks and insurance companies, and that’s something that can take a long time to master. But it’s also something which is highly respected by these buyers, whose longevity in this business is considerable. So the sooner you can start learning to speak their language, the better.

3. Identify an acute Financial Services business need that only you can solve – and focus on it.

In the Financial Services industry, you are selling to business executives, so if you’re not selling something that solves a business problem and provides real business value, they simply won’t use your solution and will look to someone else who can provide it.

If you’re a small fish in a big pond, then in order to make a splash, try to identify a business need that is somewhat ‘niche’ and aim to become a dominant solution provider for that acute business need. Once you’ve done that, you can move on to identifying the next acute business need that only you can solve. Once you have cracked that code, you can move on to the next one, etc. In the end, you’ll be addressing a very large market by having attacked smaller segments of it, one at a time.

Reuven Ben Menachem, Founder and former CEO of Fundtech and a mentor of mine, offered a great example of this strategy during his own presentation at the Carmel meetup: In the US East Coast, banks close at 17:00 which is 14:00 on the West Coast, which meant that banks on the West Coast couldn’t transfer money after 14:00. Fundtech choose to attack this issue and offer a solution to West Coast banks, allowing them to transfer money after 14:00. Eventually Fundtech’s offering expanded to other things as well but those West Coast banks, which represented just a segment of the larger market, were Fundtech’s first customers. Fundtech was able to provide a solution that met an acute need and they built on this initial success to become a company worth over a $1B.

4. Play by the rules of the Financial Services business – not by Silicon Valley rules.

When you’re a horizontal technology company, your focus is on how well your technology can translate across many verticals, which is usually how you can grow your company. When you’re a company in a particular vertical, however, the technology you offer is obviously important to that specific vertical. This is exponentially more critical in the Financial Services industry which is among the oldest in the world, having been around for hundreds and arguably thousands of years. Banks and Insurance companies are institutions that have well-established traditions, and as such, they behave very differently, and play by different rules. Anyone can see this simply by considering how different one’s interaction is with a bank or insurance company compared with popular retailers like Amazon, Expedia, eBay, etc.

For this reason, if you’re someone who is trying to grow a FinTech company, you have to play by their rules and treat the banks and insurance companies as they would expect to be treated. Since banks and insurers are generally conservative organizations, they usually prefer not to be surprised, and are not likely to appreciate having their vendors quickly “pivot”. This is an important capability of a dynamic startup which is admired in the Silicon Valley, but it could be detrimental to your credibility when your customers are bankers and insurers.

5. Financial Services companies like banks and insurers have very long memories, so be mindful that your reputation continues to form over time.

Even though the FinTech industry is a multi-billion-dollar market, it’s still comprised of the same people. They move from one organization to the other and even across continents, and they know each other. The good news is that even though we all make mistakes (which is perfectly OK, we’re all human after all), if you can be open about it, show that you’ve learned from them, and can adapt accordingly, then you’ll find that your customers can be forgiving. If you fumble, fall and quit, rather than persist, persevere and continue to provide value, then you won’t make it in FinTech. For better or worse, you are constantly being measured and your customers will respect you far more the longer you stick around and demonstrate stability, resilience and growth.

6. Even Financial Services have industry-related crises that require quick and decisive action, so you need to be ready for it.

The Financial Services industry may have existed for ages, but ups and downs every few years are a fact of life, with the most recent example being the recession of 2008/2009. During these times of crisis, those who survive the turmoil are the ones who can take quick, and even abrupt action in order to adapt, with minimal or ideally no disturbance to their clients, despite any internal difficulties. This is something that your company needs to be able to handle if it’s going to stay the course, last the distance and stand the test of time!

7. Focus on the bank/insurer’s need in US/Europe/EMEA, not the R&D needs in Israel – and reflect the business, not the technology.

This point is directed primarily at Israeli hi-tech companies who are traditionally so technologically focused that they tend to forget the customer. And as mentioned earlier, customers in the banking and financial services industry really are not interested in the technological aspect, they care about “the solution”, or in other words the way in which you can help them solve a business problem. So it’s important for Israeli FinTech companies to focus not on the local R&D’s needs, but rather on their customers’ needs (most of whom are abroad) and prioritize them accordingly.

8. Regulation is part of the Financial Services industry, so learn to live with it.

Whether you like it or not, regulation is a fact of life in the Financial Services industry, so you might as well accept it, familiarize yourself with it, and learn to navigate your business through it.

9. Financial Services companies digest technology in small bites, so to be disruptive you need to have a bold long-term vision but enable your customers to integrate it one step at a time.

The Financial Services industry is based on platforms, systems and processes that have been ingrained in organizations for many, many years, so it’s unrealistic to swoop in with a disruptive technology and expect it to be adopted right away. It will be far more palatable to your customers if you can make it possible for your solution to be integrated incrementally, so this is something that you should take into consideration when you develop your product or offering.

10. Perseverance: Enjoy the ride!

This was also my #1 tip, but it’s so particularly relevant in the world of FinTech, that it deserves reiteration. You might say that if you’re determined to see your FinTech company succeed, then you should be prepared for it to take time. You will undoubtedly face obstacles and challenges every once in a while, but while you’re at it, remember to savor all the little wins along the way as well, keep your eye on the prize, and enjoy the ride.

David speaking at Viola’s FinTech Forum meetup in May 2016. Click here to watch highlight’s from the meetup’s Q&A session which also featured Hans Morris (Managing Partner at Nyca Partners), Reuven Ben Menachem (Founder and former CEO of Fundtech), David Sosna (Co-founder & CEO, Personetics) and Yuval Tal (Founder & President, Payoneer).