As a follow up to my last blog post on 5 tips for building your startup’s financial plan, here are 3 simple slide examples you could use in an initial investor meeting – when it’s absolutely key to nail the financial overview (while the excel backup can be saved for due diligence down the road).

* Please note that the figures in the example slides below are “dummy numbers” (inserted as a demo only)

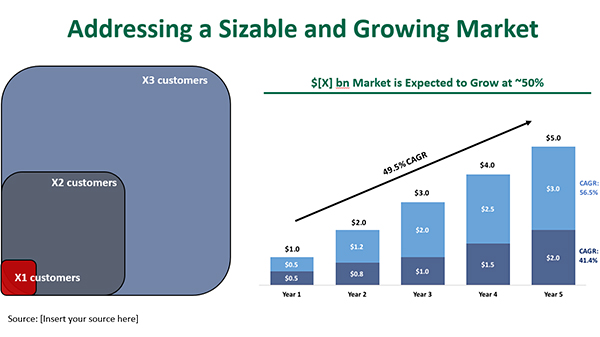

1) TAM Slide

![]() On the left-hand side of the slide, show the bottoms-up analysis of your TAM or revenue potential under each bucket (=Price x Quantity); larger buckets represent TAM expansions, i.e. either entering new markets or geographies (the Q side of the equation) or a robust tech roadmap allowing upselling which expands the P side of the equation

On the left-hand side of the slide, show the bottoms-up analysis of your TAM or revenue potential under each bucket (=Price x Quantity); larger buckets represent TAM expansions, i.e. either entering new markets or geographies (the Q side of the equation) or a robust tech roadmap allowing upselling which expands the P side of the equation

![]() On the right-hand side of the slide, show the tops-down approach to TAM, i.e. the absolute size and growth profile; try to note segment growth too as this could tell a different story

On the right-hand side of the slide, show the tops-down approach to TAM, i.e. the absolute size and growth profile; try to note segment growth too as this could tell a different story

![]() Source: It’s important to use and footnote a credible source so you can adequately defend your numbers

Source: It’s important to use and footnote a credible source so you can adequately defend your numbers

2) Financial Plan

![]() The financial overview slide needs to be at a high level, clean, rounded to one decimal place (max) and showing in $mm (or $000 as appropriate); it can be annual or quarterly – depending on the fundraising horizon

The financial overview slide needs to be at a high level, clean, rounded to one decimal place (max) and showing in $mm (or $000 as appropriate); it can be annual or quarterly – depending on the fundraising horizon

![]() Choose 2-3 KPIs that you run YOUR business by and show them at the top; make sure you answer the questions “what am I monitoring daily” and “how is success defined” if you are not sure which ones to include

Choose 2-3 KPIs that you run YOUR business by and show them at the top; make sure you answer the questions “what am I monitoring daily” and “how is success defined” if you are not sure which ones to include

![]() Revenue: You can break this into segments if it helps to tell a story, e.g. recurring revenue vs. professional services/maintenance or different product lines etc.

Revenue: You can break this into segments if it helps to tell a story, e.g. recurring revenue vs. professional services/maintenance or different product lines etc.

![]() Opex: Break down the opex into R&D, S&M, G&A and use the “comments” column to add qualitative rationale or considerations

Opex: Break down the opex into R&D, S&M, G&A and use the “comments” column to add qualitative rationale or considerations

![]() Net cash burn: This answers the question “what is the pace of burn and how long would the investment last”

Net cash burn: This answers the question “what is the pace of burn and how long would the investment last”

![]() # of employees – typically one of the largest cost buckets, it needs to drive the opex above and be realistic in terms of hiring pace

# of employees – typically one of the largest cost buckets, it needs to drive the opex above and be realistic in terms of hiring pace

![]() At the bottom, you might want to consider adding other key stats. Examples I have seen include % revenue breakdown by geography, product mix, target customers (b2b, b2c), etc.

At the bottom, you might want to consider adding other key stats. Examples I have seen include % revenue breakdown by geography, product mix, target customers (b2b, b2c), etc.

![]() Have a detailed Excel backup that can be used for follow up meeting(s) or offline review; it should also include a monthly breakdown

Have a detailed Excel backup that can be used for follow up meeting(s) or offline review; it should also include a monthly breakdown

3) Unit Economics

![]() This is a simple slide that shows you are building a sustainable business that can scale effectively

This is a simple slide that shows you are building a sustainable business that can scale effectively

![]() The slide essentially takes the lifetime gross profit from a customer and divides it by the cost it takes to find and onboard a new customer; if the ratio is 3x+, you are on the right track

The slide essentially takes the lifetime gross profit from a customer and divides it by the cost it takes to find and onboard a new customer; if the ratio is 3x+, you are on the right track

![]() Definitions relating to this slide can vary though (refer to the slide for the common definitions for each component), e.g. some versions might take into account discounting or time value of money. The calculation above, however, should provide a solid foundation for unit economics discussion

Definitions relating to this slide can vary though (refer to the slide for the common definitions for each component), e.g. some versions might take into account discounting or time value of money. The calculation above, however, should provide a solid foundation for unit economics discussion

![]() If each customer requires capex investment (e.g. a rack in a data center), you would typically add it to the denominator together with the CAC

If each customer requires capex investment (e.g. a rack in a data center), you would typically add it to the denominator together with the CAC

Thanks for all the great feedback on the prior post on building your startup’s financial plan.

Any questions, comments and/or additional thoughts? Please feel free to reach out at omryb@viola.vc