A few weeks ago, SimilarWeb successfully completed its IPO on the New York Stock Exchange, joining JFrog in the exclusive ‘US publicly-traded Israeli SaaS companies’ club.

The two are expected to be followed by monday.com, WalkMe, and SentinelOne – all recently released their S-1 filings, as well as by several other prominent Israeli SaaS companies that are rumored to go public in the near future.

A company doesn’t have to go public to be considered successful, however it is important to maintain the optionality to pursue a public listing as a means to raise capital, provide liquidity to employees and investors, and build a long term sustainable standalone company – building towards an IPO, even if it never happens, is most likely a positive strategic goal.

So what can we learn from these recent examples? What should a founder or an executive think about two-three years ahead of an aspired IPO?

There is no single profile of a public-worthy SaaS business, however there are several commonalities, and ideally in order to attract top tier institutional investors and premium valuation a company should excel in at least one or more major KPI.

Note that we are not looking to address every ingredient of a successful IPO – industry dynamics, market leadership, team excellence, addressable market, and many other factors impact the success of a public offering. We chose to focus on four very measurable metrics: 1) revenue growth, 2) gross margin, 3) net revenue retention, and 4) capital efficiency. We use these five Israeli SaaS IPOs as examples and also share a broader longer term industry benchmark.

Each one of our five IPO examples was able to find a path to excellence and become a leader in its respective category, demonstrate attractive addressable markets and industry tail winds, combined with impressive financial performance, and serve as an inspiration for many younger companies who look to follow their path. Easier said than done!

1) Growth

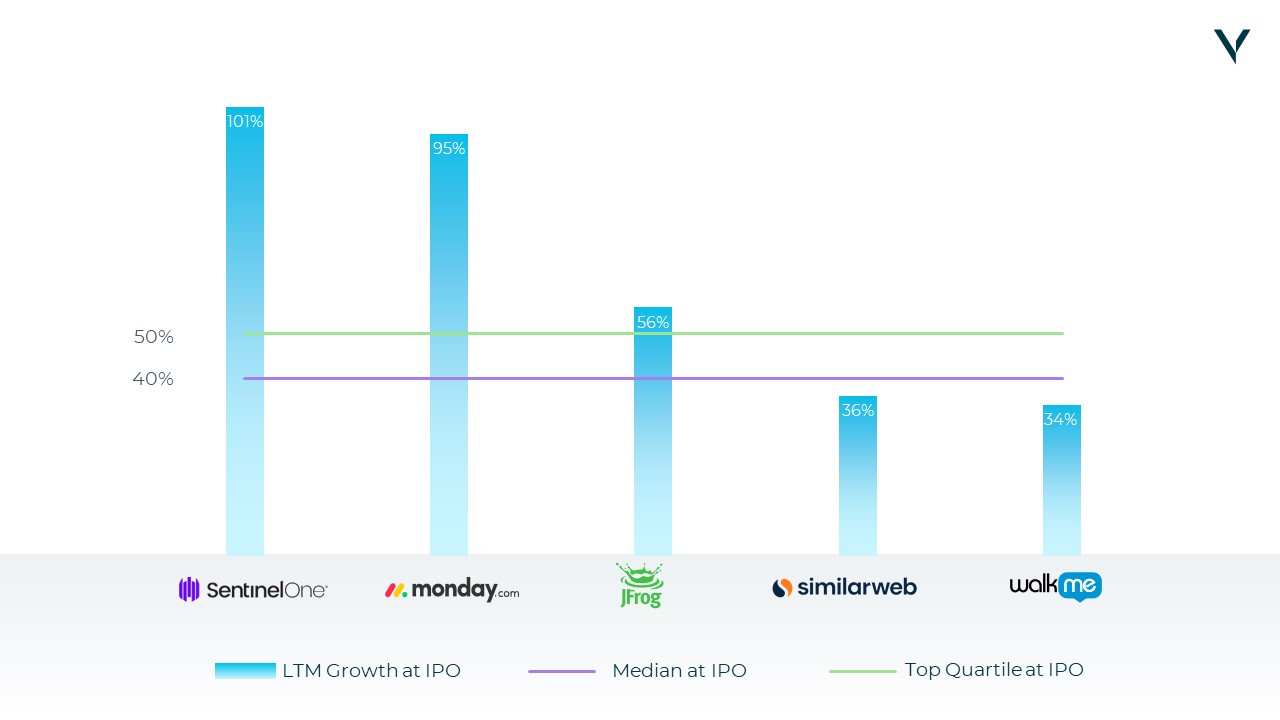

THE KPI that draws the attention of software investors today, and controls public market sentiment as we illustrated in our blog ‘best-in-class growth drives outsized value creation’. Hyper-growth software companies aim to at least double their revenues annually at pre- $100M ARR levels and maintain high double-digit growth thereafter. Top quartile SaaS companies benefit from 50% LTM growth at IPO, while the median growth stands at 40%. All five examples performed well on this metric while SentinelOne and monday.com have clearly excelled.

Sustaining these growth levels becomes harder as the company scales therefore sheer revenue scale at IPO impacts perception of a successful growth rate. A typical company has roughly $200m in revenues at IPO, however it is clearly possible to complete a successful IPO with smaller scale as all five examples illustrate.

2) Gross Margins

High gross margin serves as a proxy to the “purity” of the software component in a company’s revenue as well signals the potential to scale with high efficiency. Median gross margins for SaaS companies at IPO have remained relatively stable over the years, within the 70-75% range. Four of our examples demonstrated excellence in this KPI.

3) Net Revenue Retention

Net revenue retention (NRR), calculated as the revenue retained from existing customers, including expansions and contractions, serves as one of the leading indicators for product-market fit, growth potential, and success of a company’s overall operations. Small differences in NRR add up to very large differences in total revenue over the years and provide a powerful driver for value creation. Median NRR for companies at IPO over the past 5 years stands at 115%, while top quartile and top decile figures reached 127% and 142%, respectively. In this important KPI JFrog has performed at the top decile of SaaS companies.

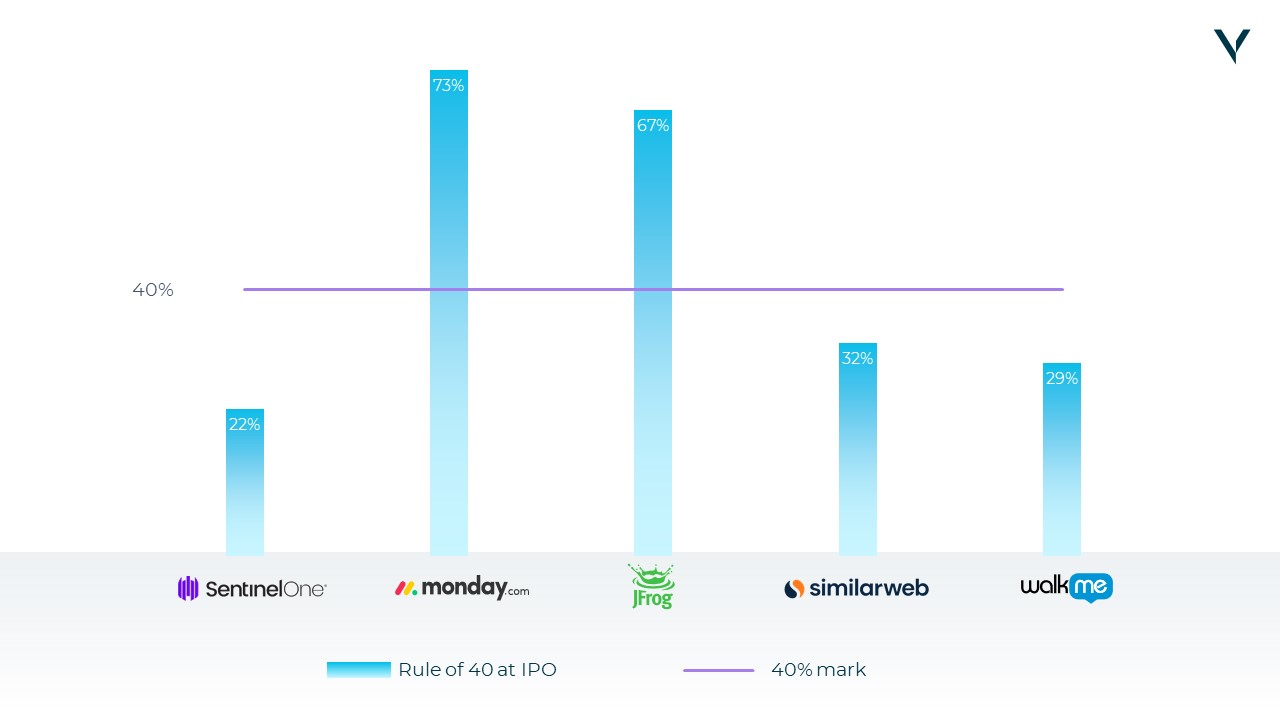

4) Efficiency as measured by the Rule of 40

While it may seem that efficiency has become a secondary consideration in today’s market, when paired with strong growth, efficiency significantly amplifies value. Efficiency can often be evaluated through the use of “The rule of 40“, which combines two key financial metrics – revenue growth and cashflow margin , and 40%+ is considered best-in-class. Monday.com and JFrog have both reached outstanding rates for this metric, 73% and 67% respectively.

Bottom line – if you are 2-3 years away from a potential IPO you should start tracking these metrics and evaluate the strategic and operational measures you need to take now in order to achieve benchmark (or better) results to maintain an option to go public – the option will prove valuable even if you don’t execute it.

____________

*Rule of 40 = Revenue Growth + FCF margin (where FCF is calculated as cash flow from operations – capital expenditures)