A few weeks ago I attended an event in which a panel of speakers discussed the Israeli VC and investment community. One of the panelists, OurCrowd CEO, Jon Medved, said at one point, “There are four guys sitting in a room – and somehow they are always guys – deciding on whether your company is good enough or not.” It’s an observation that really resonated with me, because in most cases – it is a bunch of guys who determine where the huge amounts of money pouring into the Private Equity industry all around the world will go, and as a woman in the PE industry, I feel that’s a fact that demands further exploration.

There has been much discussion in Israel around the lack of women in the high-tech industry, the lack of female entrepreneurs in general and the lack of women CEOs. Although there is a variety of initiatives dedicated to the promotion of female entrepreneurs and managers, the community that injects capital into the industry – the VC and PE community – is very light on female representation itself, particularly in senior, decision-making roles.

In 2015, women comprised only 5% of professionals employed in senior roles in the European PE industry. Across other regions, the average proportion of female senior employees grew slightly in 2015 vs. previous years, and now stands at a little above 10%. Furthermore, fewer women enter the private equity industry than men, and only a small proportion progress to take on leadership roles. Without having the data for Israel, I can only assume just by looking around me, that in Israel the percentage is even lower.

Here are some stunning figures from New Financial’s report ‘Counting every woman: gender diversity in the capital markets’:

Source: Corporate Financier, Issue 179, February 2016 & Prequin

Of course, these stats are typical of other sectors as well, but it seems that the PE industry suffers from a more severe problem. Here are some thoughts on why that might be:

![]() Private Equity – referring both to the General Partner and the Limited Partner sides (the investor side) – is a very conservative sector. Some of the large LPs hail from the large bank groups established over 30 years ago, which were very male dominated then, and continue to be led by men.

Private Equity – referring both to the General Partner and the Limited Partner sides (the investor side) – is a very conservative sector. Some of the large LPs hail from the large bank groups established over 30 years ago, which were very male dominated then, and continue to be led by men.

![]() The characteristics of private equity firms may explain the slower pace of their movement towards gender balance. According to Yasmine Chinwala, author of the Think Tank New Financial survey I mentioned earlier, “The nature of those firms is such that they tend to be founder-owned and managed. As the majority of founders are male, women begin at a disadvantage. In addition, the firms tend to be smaller, too. In a smaller firm, with fewer people, work culture becomes even more important. They’re still quite dominated by the ‘star dealmaker’ culture. That is very difficult for anyone who might need to take time out for any reason.” Many of the recruitments are from investment banking and strategy consulting backgrounds – industries that are also very male dominant.

The characteristics of private equity firms may explain the slower pace of their movement towards gender balance. According to Yasmine Chinwala, author of the Think Tank New Financial survey I mentioned earlier, “The nature of those firms is such that they tend to be founder-owned and managed. As the majority of founders are male, women begin at a disadvantage. In addition, the firms tend to be smaller, too. In a smaller firm, with fewer people, work culture becomes even more important. They’re still quite dominated by the ‘star dealmaker’ culture. That is very difficult for anyone who might need to take time out for any reason.” Many of the recruitments are from investment banking and strategy consulting backgrounds – industries that are also very male dominant.

![]() There are not enough female role models in the PE industry to pave the way for others. In Israel, people like Rona Segev from TLV Partners and Fiona Darmon from JVP were among those listed in the 2016 Globes most influential women, which is a very good start but not enough when you consider how many male partners we have out there.

There are not enough female role models in the PE industry to pave the way for others. In Israel, people like Rona Segev from TLV Partners and Fiona Darmon from JVP were among those listed in the 2016 Globes most influential women, which is a very good start but not enough when you consider how many male partners we have out there.

![]() Women find it very difficult to progress in a very male dominant environment. Some women don’t even bother trying in an effort to spare themselves the uphill battle, while others try it and end up running away. In most of the funds, you’ll see one partner who is a woman in a table of four or five male partners. Even when the guys around the table are as nice as can be, often the woman can feel a bit ‘lonely’ and often see things from a different perspective (because she is a woman) with no one else sharing her view.

Women find it very difficult to progress in a very male dominant environment. Some women don’t even bother trying in an effort to spare themselves the uphill battle, while others try it and end up running away. In most of the funds, you’ll see one partner who is a woman in a table of four or five male partners. Even when the guys around the table are as nice as can be, often the woman can feel a bit ‘lonely’ and often see things from a different perspective (because she is a woman) with no one else sharing her view.

It’s important to help women progress in any industry, but here’s why I’d like to see more women in senior roles in the Private Equity industry:

![]() The importance of Diversity in Decision making. Hanneke Smits, Co-Founder and Chairwoman of Level20, a European organization whose mission is to increase the proportion of women in PE from 5% in 2015 to 20% in 2020, recently said: “Diversity by background, including gender, does help to bring different perspectives to the table and in particularly in PE where you need to make very complex decisions. Men and women are different”. I tend to agree. Women relate to things differently and attach importance to different things than men do. When it comes to deciding where to put the fund’s money – I think this is extremely important.

The importance of Diversity in Decision making. Hanneke Smits, Co-Founder and Chairwoman of Level20, a European organization whose mission is to increase the proportion of women in PE from 5% in 2015 to 20% in 2020, recently said: “Diversity by background, including gender, does help to bring different perspectives to the table and in particularly in PE where you need to make very complex decisions. Men and women are different”. I tend to agree. Women relate to things differently and attach importance to different things than men do. When it comes to deciding where to put the fund’s money – I think this is extremely important.

Level20 surveys have also shown that women are better at ignoring market noise and developing a long-term view, whereas the average man tends to spring into action more quickly (generally speaking). In addition, other research has found that women exhibit less overconfidence than men do, take a differentiated approach to risk and are more consistent in their execution of strategy. As such, one must assume that having a woman around the table (or preferably two), will lead to better decisions and better returns.

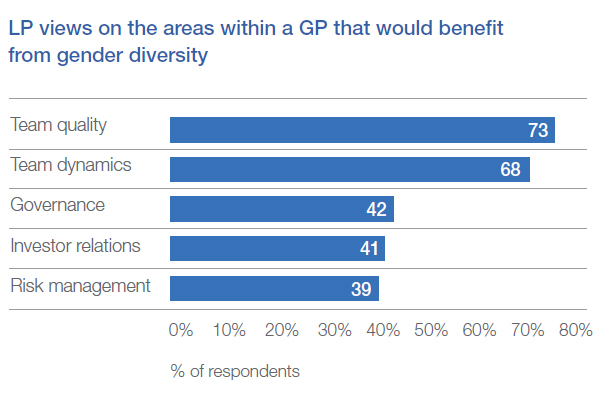

![]() Women have a different way of thinking (also called “cognitive diversity”) and a different way of interacting. This has a positive impact on the teams, both among the ranks as well as on the management teams. Recent research conducted by Coller Capital revealed that three in five LPs believe that private equity firms benefit in a general sense from having a gender diverse team, and that of those, 73% believe team quality and 68% believe team dynamics are the aspects identified as most likely to benefit.

Women have a different way of thinking (also called “cognitive diversity”) and a different way of interacting. This has a positive impact on the teams, both among the ranks as well as on the management teams. Recent research conducted by Coller Capital revealed that three in five LPs believe that private equity firms benefit in a general sense from having a gender diverse team, and that of those, 73% believe team quality and 68% believe team dynamics are the aspects identified as most likely to benefit.

Source: Women in Private Equity: The Limited Partner Perspective

(World Economic Forum, March 2016)

![]() Moving more women into PE senior roles will help create gender diversity in the investee companies themselves. A female partner will become a female board director, thus increasing the presence of women in company boards.

Moving more women into PE senior roles will help create gender diversity in the investee companies themselves. A female partner will become a female board director, thus increasing the presence of women in company boards.

A Credit Suisse Research Institute paper, published in 2012, found that companies with at least one woman on the board delivered higher average returns on equity, lower gearing, better average growth and higher price/book value multiples over the previous six years than those with all-male boards.

The follow-up Gender 3000 report on Women in Senior Management (conducted in 2014) showed that board diversity increased in almost every country and every sector, from 9.6% in 2010 to 12.7% in the end of 2013.

The survey showed that companies with higher female representation at the board level or in top management exhibit higher returns on equity, higher valuations and also higher payout ratios.

Source: Women in the Workplace 2016 by McKinsey & Company and LeanIn.org

![]() I can only assume that females are more likely to invest in female-led ventures, thus creating a more diverse entrepreneurial scene (although admittedly I don’t have data to support this assumption).

I can only assume that females are more likely to invest in female-led ventures, thus creating a more diverse entrepreneurial scene (although admittedly I don’t have data to support this assumption).

![]() It’s highly likely that having women in your team will help to boost the fund’s odds of winning a deal. These days the startup industry is generally mindful of issues that relate to society’s needs and social trends, so they are far more likely to appreciate investors who are like-minded, and who consider it just as much a priority as they do to make room for women in senior roles.

It’s highly likely that having women in your team will help to boost the fund’s odds of winning a deal. These days the startup industry is generally mindful of issues that relate to society’s needs and social trends, so they are far more likely to appreciate investors who are like-minded, and who consider it just as much a priority as they do to make room for women in senior roles.

I think that all of this data highlights the importance for the PE industry in general – and most certainly Israel’s – to actively encourage women to take on senior roles and to help them climb the ladder of leadership, and I believe that the vast majority of my Israeli VC and PE acquaintances would agree with me on this topic.

In order to create a change, we a need a long term plan. To galvanize action towards parity, the World Economic Forum and its members recently convened a working group within the Private Equity industry. The group consisted of GPs, LPs and other industry experts, who attended a workshop in October 2014 and gathered again in November 2015 for a larger follow-up forum called Women in Private Equity – the Limited Partner Perspective. The goal was to generate discussion among both LPs and GPs regarding not just the issue itself, but advancements that could be both practical and beneficial for private equity firms and their clients.

Best Practices for the promotion of gender diversity in Private Equity

The discussions during the forum’s workshops resulted in initiatives and suggestions for PE firms to promote gender diversity, which were published in March 2016. Here are the Top 10 Best Practices suggested:

Source: Women in Private Equity: The Limited Partner Perspective

(World Economic Forum briefing note, March 2016)

I believe that we in the Israeli PE Industry should be the first to adopt these best practices and I hope that our efforts will lead to some promising changes sooner rather than later.