The number of new unicorns in Israel continues to grow at an unprecedented rate, with 24 new ones announced in H1-2021 alone. By analogy, this is twice the number of new unicorns announced in China in H1’21 and only 2nd to the USA.

Israel’s $billion-companies are present across numerous verticals, from adtech (SimiliarWeb/IronSource) to Consumer (Lightricks), FinTech (eToro/Next), Infrastructure (Redis Labs/Jfrog), E commerce (Bringg), Cyber (SentinelOne), and Vertical applications (Verbit).

We set out to learn what specific characteristics, if any, drive this phenomenon.

We looked at the time-to-unicorn, revenues, and even the nature of the founders who lead these companies.

These are the insights we gleaned from an analysis of 61 Israeli unicorns:

(For this specific research we also included companies that reached the $B valuation and went public recently)

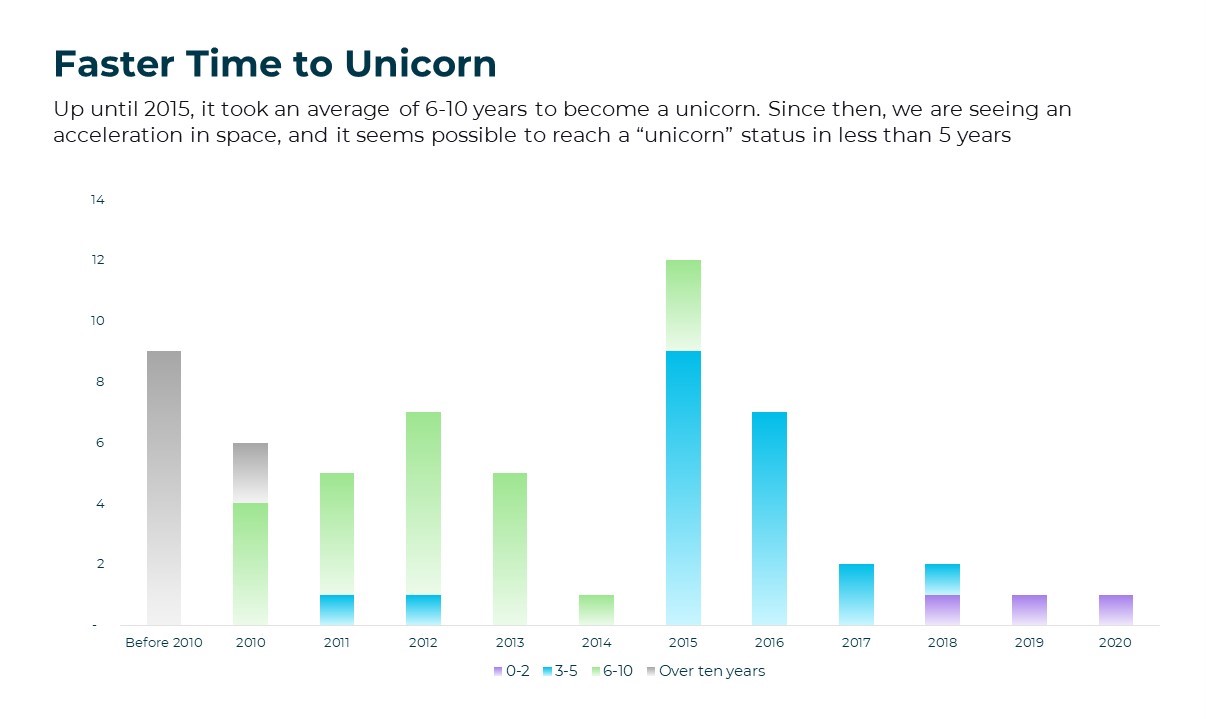

1.Faster time-to-unicorn: The maturity of the market and the founders, the growth acceleration pace, coupled with the dry powder in the tech ecosystem have significantly affected the “time-to-unicorn” parameter. For example, whereas up until 2015, it took a company 6-10 years on average to achieve unicorn status, today we see companies reach this valuation in less than five years!

For example, it took TRAX (est. 2010) over ten years to become a unicorn, but eight years for Global-e (est. 2013). By comparison, Verbit, founded as recently as 2017, reached unicorn status in just four years.

Is the $10B (‘Decacorn’) becoming the new Unicorn? It seems Israel already has seven such companies, with several more heading in the same direction.

2. The amount of capital invested to reach a unicorn status: The median investment to reach the $billion valuation stands at $109.2M, with a standard deviation of ~$55M. With funding rounds growing larger at every series, today’s companies can announce unicorn valuations on earlier rounds than ever before.

3.Revenues are less of a driver for valuation: The data shows that the level of business traction required to become a Unicorn is falling over time. While between 2013-2018, companies needed to post at least $75-100M in revenues, in 2020-2021, we see companies hitting the unicorn valuation with less than $25M in Revenues or less. The revenue multiples, however, continue to increase over time.

4. What characterizes the leaders of the Israeli unicorns?

• The majority of unicorns is still managed by the founders.

• Who are these founders? Contrary to what we imagined as the typical Israeli entrepreneur, almost third of the unicorn CEOs are NOT second-timers or tech units’ alumni (e.g., IDF’s elite intelligence unit 8200) but come from different backgrounds, including legal, marketing, or business endeavors.

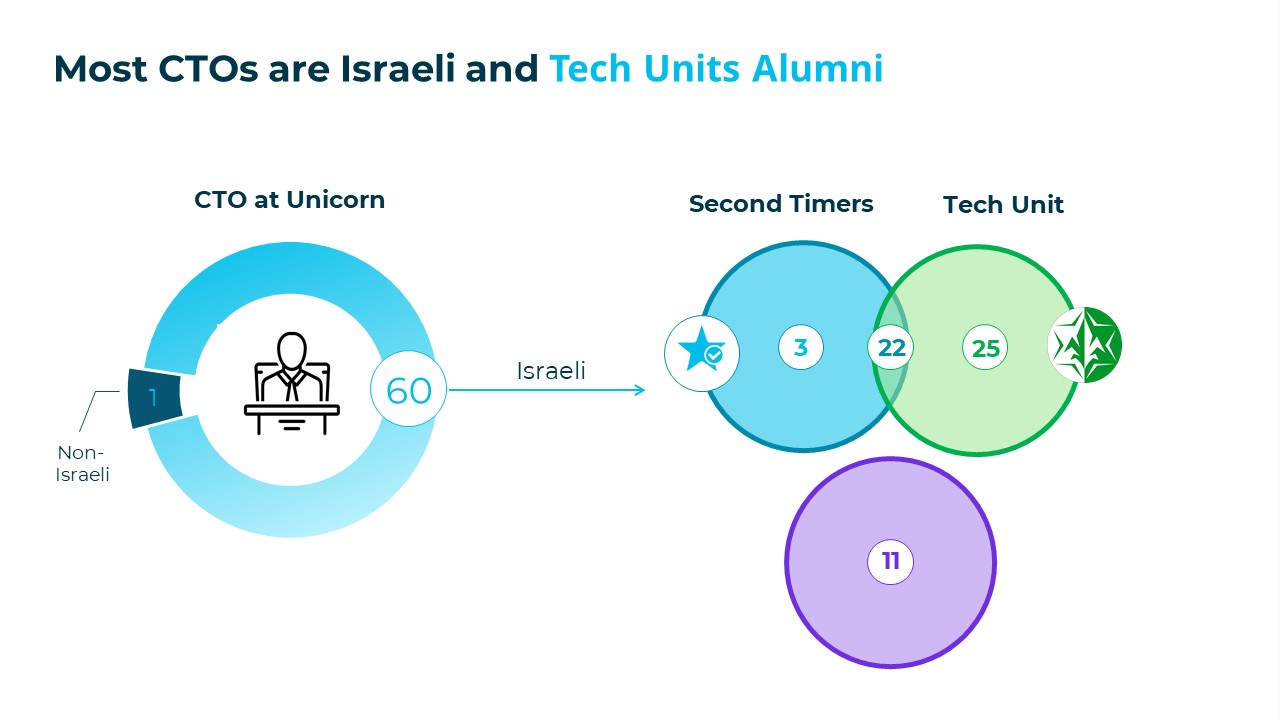

• The CTOs of the Israeli unicorns, on the other hand, are primarily Israeli with a background at one of the tech/intelligence units (>70%).

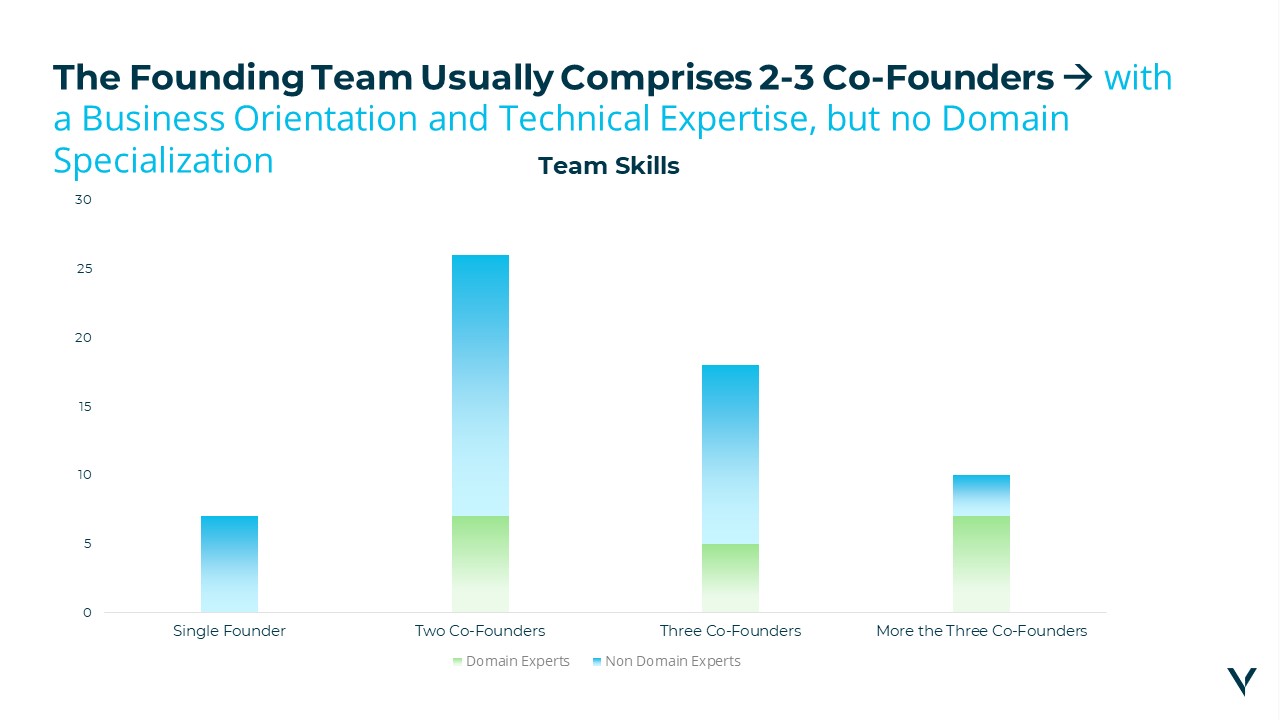

• Most (25%) of the unicorns’ founding teams comprise 2-3 co-founders, which is very typical for the teamwork-oriented Israeli tech ecosystem. However, only 11% of the unicorns had a single founder.

• Interestingly, in most cases, the founding teams possess business orientation and technical expertise but no domain expertise. For example, Outbrain’s founders had no advertising expertise. Similarly, Lemonade founders knew nothing about insurance, and the list goes on.

• This testifies to the agility of the Israeli ecosystem and its skill of building significant companies in sectors that need disruption, even without the specific background required for that domain.

• 50% of unicorn CEOs are located in Israel. We believe the trend of keeping “full managements” in Israel (including functions such as marketing, sales, and finance), and not shifting them to the destination market as used to in the past, will only strengthen as digital distribution enables a different “operational model”. Just look at Monday.com, Wix, Fiverr, IronSource, SimilarWeb and others.

For the Full Report Press Here