As with many other verticals, IT management and core business applications are also quickly moving from the old on-premise licensing model to cloud-based subscription services. In many cases it turns out that it’s just simpler and faster to rewrite the entire IT management stack from scratch rather than try to migrate the old on-premise solution to modern architecture. This trend has resulted in the creation of new “IT winners” such as ServiceNow (NASDAW: NOW), Splunk (NASDAQ: SPLK), New Relic (NASDAQ: NEWR) and others.

The migration to SaaS, coupled with the issues facing the large IT players has proven to be so challenging for the SaaS IT M&A market, to the point where significant M&As of private SaaS companies are happening much less frequently. This trend, if it continues, will require many of the emerging SaaS companies to re-think their strategy, most probably by aiming to succeed as standalone companies.

Problem #1: The IT giants are doing less and less M&A

The move into cloud computing and SaaS has caught the large IT giants off-guard. Many of them were very late to realize the magnitude of the change, causing their growth to slow and strengthening the notion that innovation is unlikely to come from those old giants. In some cases this has caused many of these companies to re-think their strategy: BMC, Dell and Compuware were all taken private in the past two years and are facing major internal re-organization; HP has announced that it is going to split into several smaller companies; and IBM’s disappointing Q3/14 results have crashed their stock prices to the lowest level since 2011.

With management of these companies now focused on their own survival and re-structuring, their M&A activity level has decreased significantly as can be seen in the table below:

Table 1: M&A activity level of IT giants has decreased significantly over a 4-year period

Problem #2: Surprisingly, the M&A activity is not around significant private SaaS companies

You’d think that the solution to the above problem would be for those IT giants to focus what’s left of their M&A activity around cloud and SaaS companies in order to diversify their product offering and close the gap on the market trends, but surprisingly, this hasn’t happened. We have seen small product acquisitions of companies with very little business traction, or alternatively, we have seen acquisition of already-public SaaS companies (as can be seen in Table 2), a trend led mostly by SAP and Oracle.

Table 2: Selected public SaaS acquisitions

Why aren’t those SaaS M&As happening? The reason is the acquirers’ inability to reconcile the SaaS financial statements with their own.

Let me explain: For years, the incumbent giants were evaluated by their profit margins and their ability to create massive amounts of cash. Some of them (IBM, CA, Microsoft, HP) have been distributing dividends for years on a regular basis.

SaaS companies, however, tend to focus on growth, raising and spending huge amounts of money to fuel that growth. In addition, the accounting practices that pro-rate revenue recognition while also recognizing expenses immediately have caused the financial statements of those companies to look much worse than they really are, accruing heavy losses and sustaining negative profit margins for years. While the public market has learned how to correct those accounting quirks by generously giving those companies high revenue multipliers, when those companies are acquired by a large player, their financials are immediately consolidated causing the acquirer to accrue heavy losses.

While this sounds more like a technical issue that should have been somehow resolved by now, several key people in those organizations whom I have met with, have told me that they see it as a major issue for which there is no foreseeable solution.

Problem #3: The emerging IT acquirers are still too small

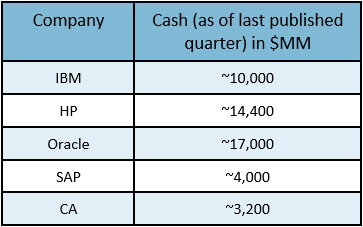

With the old giants are busy facing their internal issues, it would have made sense that the emerging IT players would aggressively invest to broaden their product offering and gain market share through non-organic growth. But although they are certainly motivated to do just that (remember, they are trying to optimize “top line” growth), they simply lack the resources. The table below shows that most of those “up and coming” companies have much less than $1 billion in cash on their balance sheet and this is not going to change any time soon due to the low pace of new cash generation. This means that significant M&A moves on their part would mean additional fund raising, dilution to shareholders etc. (as can be seen from tables 3 and 4):

Table 3: Available cash and cash generation by selected SaaS companies

Table 4: Available cash for legacy IT providers

So what can be done?

I believe that in the long run the above reality will change – because it must. One of the ‘early bird’ examples of this is definitely SaleForce.com. While not a pure IT company, it has proven that M&A of SaaS companies can significantly accelerate growth and broaden market offering. Over $4B in SaaS acquisitions such as ExactTarget, Buddy Media, Radian6 and lately RelateIQ shows its commitment to growing non-organically through SaaS M&A. Obviously, since SaleForce.com is a subscription company in its own right it doesn’t need to deal with the accounting issues mentioned above so it’s smoother sailing for inorganic growth, but I believe that other companies will follow.

SaaS companies that are achieving tens of millions of dollars in revenue will most likely realize that their smartest (and sometimes only) option for the long run is to remain standalone companies.

Strategically this will mean a few things for them:

![]() Continue rapid growth wherever possible and prepare for an IPO, with all the implications that this involves: Raising massive amounts of money, continuously upgrading management to support the required scale and focus on flawless execution.

Continue rapid growth wherever possible and prepare for an IPO, with all the implications that this involves: Raising massive amounts of money, continuously upgrading management to support the required scale and focus on flawless execution.

![]() If hyper growth is not likely – focus on putting the company on path for profitability, and bring private equity firms to replace early investors and continue to build value through strong balance sheets.

If hyper growth is not likely – focus on putting the company on path for profitability, and bring private equity firms to replace early investors and continue to build value through strong balance sheets.

![]() I believe that we are going to see more and more private-to-private mergers in order for companies to attain “critical mass” early.

I believe that we are going to see more and more private-to-private mergers in order for companies to attain “critical mass” early.

What are your feelings about what lies ahead for SaaS IT Management companies? We would love to hear your thoughts…