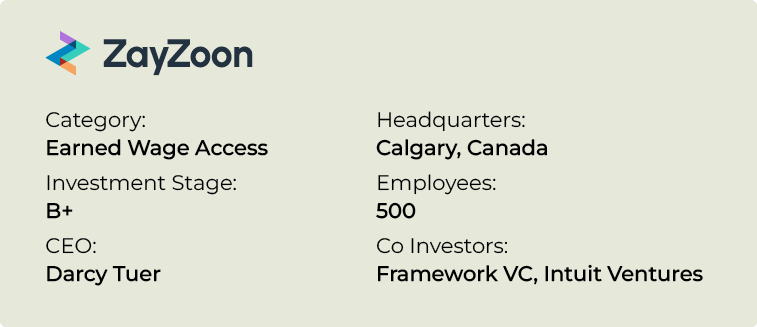

We are delighted to share news of our recent investment in ZayZoon. As a prominent Earned Wage Access (EWA) provider catering to small and medium-sized enterprises, ZayZoon has distinguished itself within the industry. They are revolutionizing financial services by introducing innovative products that bridge the gap between payroll, employers, and employees, all aimed at fostering financial empowerment for every individual. Notably, ZayZoon’s unique vision on the employee side as well as their efficient distribution framework on the employer side is perfectly aligned with our thesis on contextual financial services. We are incredibly enthusiastic about supporting ZayZoon in its important mission.

ZayZoon Founders: Jamie Ha(CFO), Darcy Tuer (CEO), Tate Hackert (President)

Here is a short interview we held with the Co-Founder and CEO, Darcy Tuer:

Q: How did you start your entrepreneurial journey?

A: My first entrepreneurial journey was at 16, when I drove to people’s houses to teach their kids piano and bundled being a babysitter into the service to give myself an “unfair advantage”, It was very lucrative for a 16-year-old, and I had more demand than supply – I should have thought about hiring more teachers!

After that was my first entrepreneurial journey in the formal sense, when I started Halo Networks in 2000, capturing data digitally in the field to improve engineering, analysis, and efficiency from field data capture to decision making.

Q: What is the company’s mission and how do you plan to pursue it?

A: ZayZoon is on a mission to save 10 million people 10 billion dollars. In 2016, we committed to a go-to-market predicated on partnering with US payroll and PEO providers. Our growth engine is a cascading model that involves partnering with new payroll providers (today, we have 170+ partners), activating their employer clients, and making the service visible to their employees through multiple product and marketing motions.

Q: Tell us the story behind starting the company

A: The story started when I was introduced to my Co-founder, Tate Hackert, in 2014 when I was in the process of exiting my second startup. Tate shared stories of putting ads up on Craigslist offering people short-term loans with 250,000 of his own money to help good people who just experienced a few bad breaks and for whom AWFUL payday loans and gratuitous bank fees were their only other options.

When Tate and I finished developing the proof-of-concept and firmly believed we were onto something, we met our 3rd co-founder, Jamie Ha, at a local start-up event. He was a recovering investment banker and was looking to invest his capital and time into building and operating a purposeful business. Jamie leveled up our understanding of the financial aspects we’d need to be successful and has been an indispensable partner.

ZayZoon fills the wage access gap by providing earned wage access (EWA) capability to all employers, so their most important asset, their employees, can have access to their hard-earned wages and other financial benefits that will help improve their financial security. With enough payroll partnerships and employers willing to “flip a switch”, we will help more than 10 million employees in their time of financial need, to feel empowered and associate this important benefit with their employer leaning in to take an active role in their health and wellness.

Q: What is your moat? How do you think you stand out?

A: Our moat starts with our values. We genuinely care about our customers. That comes through in the people we hire, our partnerships, our curiosity about the problems we can help with, our product strategy, and our single-minded purpose of creating value for employers and their employees.

The capabilities we’ve built as a result of those values have made ZayZoon the fastest-growing EWA provider for businesses in the US with less than 2000 employees, commonly referred to as SMBs. At a recent conference, more than 75% of the payroll attendees were partnered with ZayZoon, and they love working with us; that’s a significant advantage when it comes to our growth and makes it difficult for others to gain market share.

Q: What are you most proud of?

A: Everyone remembers March 2020. At the time, we had 33 employees and were serving just over 10,000 customers. We were in term sheet negotiations for our Series A financing. As you can imagine, those discussions evaporated overnight. We told staff that they could work from home if they preferred and literally, the next day, it was only me and my two co-founders in the office – it was clear we were experiencing a black swan event.

Despite the unprecedented challenges, our response became my proudest moment for the company. We built a working document that highlighted all employees and employers that we suspected were actively working to help people through the pandemic – medical delivery companies, grocery workers, long-term care, manufacturing, etc. We kept ZayZoon running for them, even when we knew the capital risk was impossible to calculate as the situation was entirely unpredictable. Beyond that response, we ended up getting through the pandemic without laying off a single member of our team.

Q: Where will the company be 5 years from now?

A: We believe that EWA will be solved over the next few years with ZayZoon as the firmly established dominant player for SMBs in the US and Canada and poised for growth in additional markets.

Payroll providers will be expected to offer EWA as an embedded capability. Employers will find indispensable utility in ZayZoon as it improves recruitment, retention, and contributes to the health of their employees, which is connected to productivity in the workplace.

In terms of scale, we will be helping millions of employees across hundreds of thousands of businesses access important financial products that improve their connectedness to their employers and path to financial health.

click here to visit ZayZoon website.

ZayZoon Team